So that you’re dreaming of your subsequent trip: a comfortable cabin getaway, or a wide-open sandy seashore: one thing to only get you away out of your present grind. The situation is nearly set, now you simply want to economize to get you there.

Think about this: what should you might pay for your whole journey prices with out bumping up your bank card debt by a single penny? You’ll be able to! Right here’s the best way to use YNAB to plan that breath of rest, journey, and save for a trip free of cash stress.

1. Identify Your Trip

Flip your dream trip right into a actuality by giving it a reputation, and a spot to park some {dollars}.

When and the place are you going? Write it down. Growth, identical to that your mystical sometime trip feels immediately prefer it’s going to occur and also you’ll be there quickly to ship a postcard.

Whereas some private finance gurus may suggest opening a devoted trip financial savings account or checking account, wouldn’t or not it’s less complicated to not? We observe all of our trip funds in YNAB—it’s a zero-based finances app the place you possibly can earmark your journey funds in digital envelopes with out having 15 totally different financial institution accounts.

You’ll be able to obtain a money-saving app like YNAB to plan to your trip and save for it on the similar time.

2. Set Your Financial savings Aim

What’s your journey finances? Perhaps you need to go to Disney, the place the common value for a household of 4 is simply shy of $6,000.

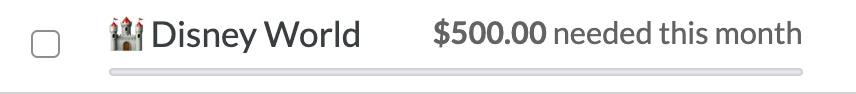

Attempt breaking down your loved ones trip prices into smaller month-to-month financial savings. In YNAB, we make this straightforward! You’ll be able to set a goal for the way a lot you need to earmark in complete to your Disney trip. YNAB will do the mathematics to your and create your month-to-month financial savings plan in accordance with your inputs.

On this instance, the household needed to save lots of $6,000 for his or her Disney trip subsequent summer time.

YNAB’s built-in calculators lets them know they’ll have to stash away $500/month main as much as the journey.

That may really feel actually extra doable than a mountain of $6,000 abruptly. If this goal quantity isn’t lifelike for the place you’re proper now, attempt pushing the date out a bit, shortening your journey, or make a plan to herald more money. Hold adjusting till it feels best for you.

Every month, you’ll set this chunk of cash apart and also you’ll see your progress towards your subsequent journey in your month-to-month finances.

3. The Enjoyable Half: Do Some Analysis

Now that is when the enjoyable actually begins: time to perform a little research. Try these stunning, reasonably priced, can’t-miss, distinctive locations to eat, sleep, see, and do, after which begin planning your enjoyable across the stuff you’re most enthusiastic about. Then, don’t overlook to take a look at prices for airfare, lodge stays, and different travel-related prices.

You’ll begin to get an image of the monetary items of your trip. If it’s seeming costlier than you initially deliberate, take a look at budget-friendly journey suggestions, get inventive with meals prices (Costco groceries?), and even get inventive with journey rewards packages to chop down on airline prices.

With every part specified by entrance of you, it’s the right view to tweak and prioritize the place your {dollars} have to go to your trip planning. Perhaps you set your lodging finances as little as potential since you’ll be out and about anyway! Or, you would sacrifice on different areas and splurge on an onsite property (with a pool! Sure, please!).

At this level, possibly you even threw within the towel completely in your unique plan and go for a low-cost highway journey or staycation as an alternative! This trip plan is as much as you, and also you’ll know the route you need to take.

4. Agency Up Your Plan

When you’ve performed your analysis and have a good suggestion of how a lot you’ll spend, you may get just a little extra granular along with your bills. When you’re nonetheless saving up the total quantity for the holiday, you possibly can set targets on these classes to trace your progress. Or, if you have already got the cash put aside, go forward and begin assigning the {dollars} to the classes they should go to.

5. File Your Spending

When you begin paying deposits or shopping for tickets, you possibly can file your spending in YNAB and it’ll maintain a operating record of your balances—no have to do any psychological math!

Generally you’ll have cash left over in classes, or generally you’ll go over in different classes. We name this “rolling with the punches” and you may transfer cash from one class to a different to cowl overspending or unfold the surplus.

It’s also possible to maintain issues like affirmation numbers, journey rewards bank card data, telephone numbers and Airbnb host names within the notes part of YNAB in order that they’re straightforward to reference. Your finances works even once you’re offline so it’s a dependable place to maintain data you may want at any second.

6. Get pleasure from a Stress-Free Trip

Whenever you lastly take that dreamy trip, you possibly can really feel fully relaxed and fully at peace with spending whereas on trip (simply the way it ought to be). You’ll know the holiday is funded in money, you’re not moving into bank card debt whereas we scarf down an unbelievable delicate pretzel, and as a significant added plus…your notes save the day for journey particulars once you’re brief on a wifi connection.

Publish Trip: All of the Recollections, Not one of the Debt

As soon as the holiday is over you may even have a number of {dollars} left out there! YNAB makes it straightforward to maneuver cash round to your subsequent thrilling journey or precedence, and you may conceal the class so you continue to have all the information. This may turn out to be useful once you need to bear in mind the title of the Airbnb, how a lot the rental automotive was, or the place you had that scrumptious pulled pork sandwich.

Every journey might be archived or hidden in YNAB and it’s enjoyable to have a file of all of the enjoyable journeys you’ve been and eager about the place you’ll go subsequent. It additionally brings again nice reminiscences simply all of the locations you’ve been and eager about the place you’ll go subsequent. And you understand what the easiest way to finish a trip is? Planning your subsequent one.

Completely happy Budgeting!

Need some extra trip budgeting inspiration? Watch as Ashley takes us by the best way to save for a dream trip in YNAB, plus all of the instruments you want for easy planning.