My early educational work was on the Phillips curve and the precision in estimating the idea of a pure price of unemployment, or the speed of unemployment the place inflation stabilises at some stage. This price is now generally known as the Non-Accelerating-Fee-of-Unemployment (NAIRU) and my contribution was one of many first research to indicate that the speed was variable and went up and down with the financial cycle, rendering it a meaningless idea for discretionary coverage interventions. I prolonged that work into my PhD and constructed on a lot earlier work as a undergraduate to articulate the Job Assure thought. The NAIRU is unobservable and there have been numerous methods to estimate it from precise knowledge. The issue is that these estimates are extremely delicate to the strategy – so two researchers can get fairly totally different estimates utilizing the identical knowledge. Additional, the estimates themselves are topic to giant statistical errors which means that we can’t be certain whether or not the NAIRU is say 4.5 per cent or 3.5 per cent or 5.5 per cent, say. Such imprecision makes it unattainable to make use of the idea as a information for financial coverage as a result of if the NAIRU really existed then ‘full employment’ may be at 3.5 or 5.5 per cent at this time however subsequent week the estimates may be even wider. When would one wish to begin altering rates of interest in pursuit of inflation stability – when the precise unemployment price was down to three.5 per cent or at 5.5 per cent or someplace in between or at greater or decrease unemployment charges, relying on what the fashions pumped out? You may see the issue. For some years, central bankers went quiet on using the NAIRU and stopped publishing their estimates precisely as a result of they knew full properly concerning the imprecision and that coverage based mostly on such a imprecise, tough to estimate, unobservable can be discredited. That’s till now. The RBA is now clearly admitting that their damaging and pointless rate of interest hikes during the last yr and a bit have been pushed by the NAIRU. A sham. However a tragedy as properly given the RBA’s nearly obsession with pushing unemployment up by round 140,000. A surprising indictment of the place now we have reached as a civilisation.

First to Japan

Each day the Financial institution of Japan sends me E-mail briefings of the developments in Japan for that day. It’s a very priceless supply of knowledge.

Yesterday’s briefing included the – Minutes of the Financial Coverage Assembly on April 27 and 28, 2023 – which detailed the discussions on the final Coverage Board assembly.

Studying them is like being in a parallel universe when in comparison with the statements which have been popping out of different central banks, together with the most recent – Minutes of the Financial Coverage Assembly of the Reserve Financial institution Board (revealed June 6, 2023).

We learn:

1. “In accordance with the short-term coverage rate of interest of minus 0.1 % and the goal stage of the long-term rate of interest, each of which had been determined on the earlier assembly on March 9 and 10, 2023, the Financial institution had been conducting purchases of Japanese authorities bonds (JGBs)” – so they’re persevering with to make use of their dominant place within the authorities bond markets to keep up low rates of interest – unmoved by what different central banks are doing.

2. “The Financial institution will buy a obligatory quantity of JGBs with out setting an higher restrict in order that 10-year JGB yields will stay at round zero %” – they’re shopping for JGBs “each enterprise day” to make sure yields stay at “round 0 per cent”.

3. “the form of the JGB yield curve had been typically clean, as rates of interest had declined, primarily at medium- to long-term and super-long-term maturities” – thus offering good funding situations for long-term capital formation. Wise.

4. “Within the cash market, rates of interest on each in a single day and time period devices typically had been in unfavorable territory.”

5. “Within the international alternate market, the yen had appreciated towards the U.S. greenback … In the meantime, the yen had depreciated towards the euro” – so no exhausting and quick rule that such a financial and expansionary fiscal stance would drive the yen in direction of collapse.

6. “Japan’s financial system had picked up, regardless of being affected by components equivalent to previous excessive commodity costs” – whereas financial exercise around the globe declines on the again of the rate of interest hikes.

7. “The employment and earnings state of affairs had improved reasonably on the entire.”

8. “In actual phrases, the year-on-year price of change in worker earnings was projected to progressively flip constructive towards the center of fiscal 2023, as inflation declined and nominal worker earnings improved” – employees of the world unite!

9. “With the impression of previous excessive commodity costs and yen depreciation progressively waning, the speed of change within the producer value index (PPI) relative to a few months earlier had began to say no barely, partly because of the results of the federal government’s measures to scale back the burden of upper electrical energy and gasoline costs” – so fiscal coverage interventions had been anti-inflationary.

10. “Inflation expectations had been kind of unchanged after rising” – so though rates of interest are unchanged and financial coverage is expansionary, individuals are not constructing the momentary elevated inflation stage into their choice making. They realise this can be a transient section and persistence is the important thing.

11. “the year-on-year price of improve within the CPI (all objects much less recent meals) was anticipated to decelerate towards the center of fiscal 2023, with a waning of the results of the pass-through to shopper costs of value will increase led by the rise in import costs” – they based mostly their coverage choices on the belief that the inflationary pressures had been transitory and the occasions are validating that justification. Smarter than the remaining.

12. “in an effort to obtain the worth stability goal of two % in a sustainable method, this wanted to be accompanied by wage will increase … it was obligatory for the Financial institution to proceed to firmly help the momentum for wage hikes by sustaining financial easing in order that the nominal wage progress price would rise sufficiently relative to costs” – which is official authorities coverage to push up wages progress. Parallel universe!

There was way more within the Minutes however this offers you an thought of how far faraway from the remainder of the central banking narratives, the Financial institution of Japan is.

Ministry of Finance and the Cupboard Workplace enter into the discussions had been supportive of the Financial institution’s accommodative stance persevering with and there have been statements affirming the Cupboard Workplace’s intention to swiftly implement the most recent fiscal expansionary measures.

A parallel universe certainly.

Previous central financial institution scepticism

Right here some quotes I dug out from my database this morning.

The primary was from an deal with on November 29, 1994 – Inflation, Present Account Deficits and Unemployment – that the then RBA Governor Bernie Fraser gave to CEDA in Melbourne, which was subsequently revealed within the December 1994 version of the RBA Bulletin:

This has led to the notion of a ‘pure’ price of unemployment, or what economists have referred to as the Non-Accelerating Inflation Fee of Unemployment, or the NAIRU – both approach, a horrible mouthful. In easy phrases, it’s a minimal unemployment price under which the financial system can not function for any sustained interval with out producing wage pressures and pushing up inflation. No-one is aware of exactly what this minimal price is, however totally different researchers have steered a variety of 6 to eight per cent for Australia, with most estimates in direction of the highest of this vary. Estimates for some European nations are usually greater nonetheless, at 8 to 9 per cent; for the US, it’s typically considered round 6 per cent.

It’s a fuzzy idea and of restricted sensible worth.

The quick observe to the August 24, 2018 speech that the Federal Reserve Financial institution boss Jerome Powell gave on the Jackson Gap Symposium – Financial Coverage in a Altering Economic system:

With the unemployment price properly under estimates of its longer-term regular stage, why isn’t the FOMC tightening financial coverage extra sharply to go off overheating and inflation? …

In standard fashions of the financial system, main financial portions equivalent to inflation, unemployment, and the expansion price of gross home product (GDP) fluctuate round values which are thought-about “regular,” or “pure,” or “desired.” …

These elementary structural options of the financial system are additionally recognized by extra acquainted names such because the “pure price of unemployment” and “potential output progress.” … On the Fed and elsewhere, analysts speak about these values so usually that they’ve acquired shorthand names. For instance, u* (pronounced “u star”) is the pure price of unemployment … In response to the traditional pondering, policymakers ought to navigate by these stars. In that sense, they’re very a lot akin to celestial stars …

if the unemployment price is above u*, decrease the actual federal funds price relative to r*, which is able to stimulate spending and lift employment.

Navigating by the celebs can sound simple. Guiding coverage by the celebs in follow, nevertheless, has been fairly difficult of late as a result of our greatest assessments of the situation of the celebs have been altering considerably.

After which a yr later (August 25, 2019), on the Jackson Gap once more, the RBA governor Philip Lowe’s – Remarks at Jackson Gap Symposium – invoked the ‘shifting stars’ in his speech:

Over current instances there have been very giant shifts in estimates of full employment (U star) …

These shifts have occurred not simply in a single or two nations, however they’ve occurred nearly in all places. The truth that the expertise is so frequent throughout nations strongly suggests there are some world components at work.

It’s price noting that these shifts within the stars weren’t predicted – they’ve come as a shock … the fact is that our understanding remains to be removed from full about what constitutes full employment in our economies and the way the equilibrium rate of interest goes to maneuver sooner or later.

Which all goes to indicate that the central financial institution bosses know full properly that the NAIRU shouldn’t be a dependable foundation for extra exact coverage modifications.

Economists have no idea when the estimates of the NAIRU will shift nor what causes them to shift.

I’ve documented beforehand the deep uncertainty within the estimates supplied by central banks – see the in depth Background Studying listing on the finish of this weblog submit.

On June 12, 2019, the Assistant RBA Governor gave a speech in Melbourne – Watching the Invisibles – the place she talked concerning the NAIRU.

She mentioned that in inferring some quantity for the NAIRU (an unobservable) from different seen variables, one is “asserting {that a} explicit idea, a selected mannequin of how the world works, is true.”

If the idea is unsustainable, then the inference will likely be ineffective.

She asserted, although that the idea has credence that:

… there’s a stage of unemployment under which wages progress begins to choose up meaningfully. You may see when an financial system has reached that time. That’s all that the NAIRU is – the label we give to that time.

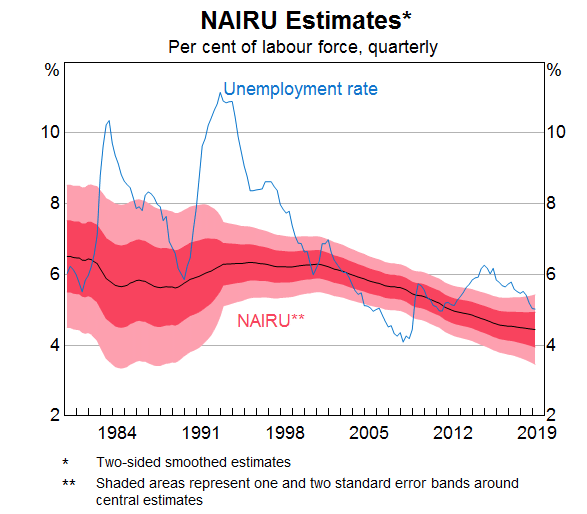

She additionally revealed the, then, newest RBA estimates of the NAIRU which is depicted on this graph:

She notes in relation to the graph that:

There’s substantial uncertainty round our estimate of the NAIRU. First, there’s uncertainty across the estimate of the NAIRU even when assuming this mannequin of the connection between wages, inflation and the unemployment hole is the most effective mannequin. It’s because even with your best option of statistical strategy, it’s tough to be exact about that relationship. The mannequin estimates that there’s a two-thirds probability that the present NAIRU is between 4 and 5 per cent, and a 95 per cent probability it’s between 3½ and 5½ per cent …

For the non-statisticians studying this, the related phrase is “a 95 per cent probability it’s between 3½ and 5½ per cent”.

What which means is that the RBA has no approach of differentiating utilizing this kind of methodology between a NAIRU of three.5 per cent and a NAIRU of 5.5 per cent, which is the purpose I made earlier.

A 2 per cent vary is just too imprecise for coverage choices when they’re manipulating rates of interest 0.25 foundation factors at a time.

At current, the Australian unemployment price is 3.55 per cent, but the RBA is claiming the NAIRU is 4.5 per cent (which is the ‘level estimate’ from their modelling) round which these confidence intervals lie.

They’re growing charges on the idea that the present unemployment price is ‘under’ the purpose estimate of the NAIRU however statistically they haven’t any approach of understanding whether or not the present unemployment price is above the NAIRU of three.5 per cent.

She claimed in that speech, that:

However given what we’re seeing within the knowledge, proper now we really feel snug about being a bit extra particular than that.

How?

Actions in wages.

Okay, possibly.

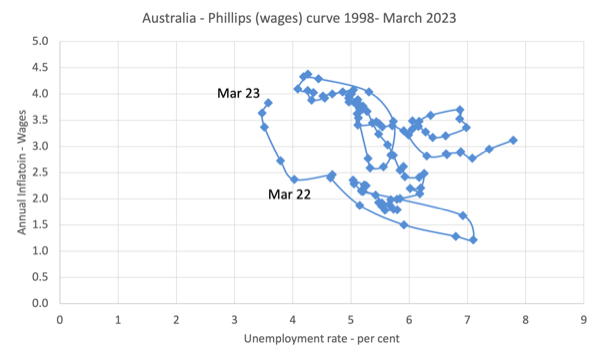

However take a look at this graph, which exhibits the connection between the official unemployment price for Australia on the horizontal axis and the annual price of progress within the Wage Value Index (wages progress) on the vertical axis.

The pattern is the September-quarter 1998 to the March-quarter 2023 (newest knowledge).

The unemployment-wage inflation relationship is far and wide and it will be exhausting to make judgements concerning the relationship between the 2 variables utilizing this knowledge.

Whereas there was an acceleration in wages progress lately (nonetheless properly under the inflation price) it follows a drawn out interval of report low wages progress.

So, we could also be simply seeing an adjustment again to extra regular behaviour.

However attempting to get any clear impression on when the connection flattens out – in order that the unemployment is related to secure inflation – is just about unattainable.

Eyeballing the information might generate a NAIRU estimate of 4 per cent and even almost 7 per cent.

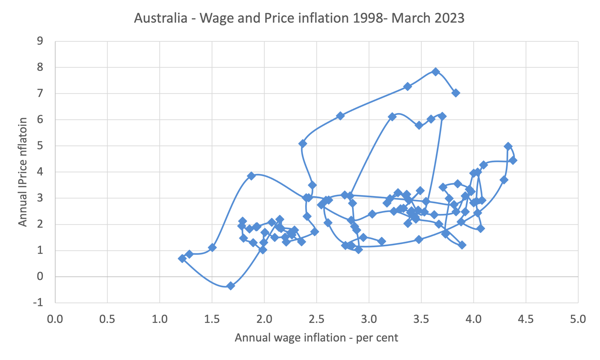

And to compound the confusion, right here is the connection between annual wage inflation (horizontal axis) and annual value inflation (vertical axis).

Within the present interval, wages progress elevated during the last 6 months, but CPI inflation is falling at a time when the unemployment price was falling (see earlier graph).

I can do countless comparisons like this and the end result will likely be that there isn’t any systematic, detectable or secure relationship between unemployment charges and actions in wages.

Latest RBA feedback

Earlier this week (June 20, 2023), the Deputy Governor of the RBA was in Newcastle for a enterprise occasion (they duchess enterprise often) and her speech was entitled – Reaching Full Employment.

She claimed that “simply because our inflation goal has been in focus lately, it doesn’t imply that the opposite a part of our mandate – sustaining full employment – has turn out to be any much less essential. Full employment is, and has at all times been, one among our two principal aims.”

Effectively that’s their duty beneath the Reserve Financial institution Act 1959 so it needs to be one of many aims.

However the way in which they’ve spherical that legislative duty and began utilizing unemployment as a coverage instrument relatively than a coverage goal was to redefine what full employment meant.

That’s what the NAIRU is about.

Relatively than expressing full employment because the variety of jobs which are required to fulfill the demand for work by the labour power, mainstream economists claimed that the NAIRU was full employment – which ties the idea to secure inflation.

So within the Eighties, after the chaos of the oil shocks my occupation had the audacity to assert that full employment was round 8-9 per cent unemployment, as a result of their silly NAIRU fashions delivered that end result.

Then because the unemployment price fell once more to a lot decrease ranges but inflation didn’t speed up, they needed to revise the NAIRU estimates down.

Complete sham.

The Deputy Governor obtained caught up right here.

She launched the NAIRU into her Speech however then mentioned:

When discussing full employment, within the context of a central financial institution’s mandate, economists sometimes discuss concerning the non-accelerating inflation price of unemployment – the NAIRU. I’ll come again to this idea. However, extra typically, full employment signifies that individuals who desire a job can discover one with out having to seek for too lengthy. As I’ll emphasise later, the variety of hours of labor that folks can safe can also be essential in defining full employment.

So which is it?

Sufficient jobs or the NAIRU.

Confusion.

She later admitted that:

For financial coverage, our value stability mandate requires a narrower idea of full employment.

Narrower than sufficient jobs.

She then admitted that the RBA makes use of the NAIRU to find out whether or not there’s full employment or not and that at present:

… employment is above what we’d contemplate to be in step with our inflation goal.

So the intention is to destroy jobs and other people’s livelihoods based mostly on this idea that no-one can see and even estimate with any accuracy.

1. The labour power in Australia in Could 2023 was estimated to be 14,527.7 thousand in seasonally adjusted phrases.

2. Unemployment in Could 2023 was 515.9 thousand leading to an official unemployment price of three.55 per cent.

3. A 4.5 per cent unemployment price would imply 653.7 thousand employees can be categorized as unemployed.

4. As well as, extra employees would enter hidden unemployment because the participation price fell with the diminished job alternatives and underemployment would additionally rise.

5. So the RBA is eager to deprive 137.8 thousand employees who’re at present employed of the prospect to work all as a result of they assume the NAIRU is at 4.5 per cent (or thereabouts), whereas, on the similar time, understanding it could possibly be someplace between 2 and seven per cent (roughly) at current and unstable over time.

Conclusion

A surprising indictment of the place now we have reached as a civilisation.

Background Studying

Common readers will know that I’ve written concerning the NAIRU idea earlier than and have finished years of labor on the subject:

1. My PhD thesis included plenty of technical work (theoretical and econometric) on the subject – starting within the mid-Eighties, after I was simply beginning out.

2. In my 2008 guide with Joan Muysken – Full Employment deserted – we analysed the technical facets of the NAIRU intimately.

3. Many refereed educational papers.

4. The next weblog posts (amongst others):

(a) RBA attraction to NAIRU authority is a fraud (February 23, 2023).

(b) The NAIRU ought to have been buried a long time in the past (December 9, 2021).

(c)The NAIRU/Output hole rip-off reprise (February 27, 2019).

(d) The NAIRU/Output hole rip-off (February 26, 2019).

(e) No coherent proof of a rising US NAIRU (December 10, 2013).

(f) Why now we have to study concerning the NAIRU (and reject it) (November 19, 2013).

(g) Why did unemployment and inflation fall within the Nineteen Nineties? (October 3, 2013).

(h) NAIRU mantra prevents good macroeconomic coverage (November 19, 2010).

(i) The dreaded NAIRU remains to be about! (April 6, 2009).

So I feel I’m certified to debate the subject.

That’s sufficient for at this time!

(c) Copyright 2023 William Mitchell. All Rights Reserved.