What’s the Public Provident Fund PPF Curiosity Charge 2023? How usually the curiosity modifications for PPF? What’s the historical past of the Public Provident Fund or PPF rate of interest from 1968 to 2023?

Public Provident Fund or PPF is among the most well-liked merchandise for a lot of buyers. In truth, I strongly advocate utilizing this product as your debt a part of the portfolio. It’s 15 years product, with tax advantages on the time of funding and likewise on the time of maturity. Therefore, contemplate this product provided that your time horizon of the aim is greater than 15 years.

I already wrote many articles about Public Provident Fund. Refer the identical (record shared).

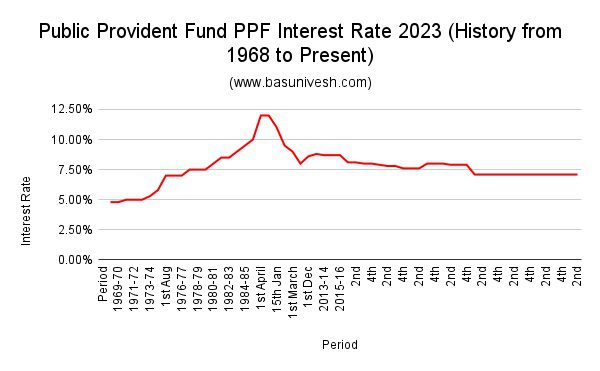

Public Provident Fund PPF Curiosity Charge 2023 (Historical past from 1968 to Current)

Earlier the rates of interest was once introduced on yearly as soon as. Nonetheless, from 2016-17 onwards, the speed of curiosity might be fastened on a quarterly foundation. I already wrote an in depth publish on this. I’m offering the hyperlinks to these earlier posts under.

Based mostly on these new modifications, now onward rate of interest might be declared on a quarterly foundation.

Beneath is the timetable for change in rates of interest for all Put up Workplace Financial savings Schemes.

Therefore, from 1968 to 2016, the rate of interest of public provident fund was once modified on a yearly foundation (or generally primarily based on the financial coverage). However from 2016 onwards, it’s on a quarterly foundation.

Allow us to now look into the Public Provident Fund PPF Curiosity Charge 2023 (Historical past from 1968 to Current).

| PPF Curiosity Charge Historical past from 1968 to Current | |

| Interval | Curiosity Charge |

| 2nd Quarter of 2023-24 | 7.10% |

| 1st Quarter of 2023-24 | 7.10% |

| 4th Quarter of 2022-23 | 7.10% |

| third Quarter of 2022-23 | 7.10% |

| 2nd Quarter of 2022-23 | 7.10% |

| 1st Quarter of 2022-23 | 7.10% |

| 4th Quarter of 2021-22 | 7.10% |

| third Quarter of 2021-22 | 7.10% |

| 2nd Quarter of 2021-22 | 7.10% |

| 1st Quarter of 2021-22 | 7.10% |

| 4th Quarter of 2020-21 | 7.10% |

| third Quarter of 2020-21 | 7.10% |

| 2nd Quarter of 2020-21 | 7.10% |

| 1st Quarter of 2020-21 | 7.10% |

| 4th Quarter of 2019-20 | 7.90% |

| third Quarter of 2019-20 | 7.90% |

| 2nd Quarter of 2019-20 | 7.90% |

| 1st Quarter of 2019-20 | 8.00% |

| 4th Quarter of 2018-19 | 8.00% |

| third Quarter of 2018-19 | 8.00% |

| 2nd Quarter of 2018-19 | 7.60% |

| 1st Quarter of 2018-19 | 7.60% |

| 4th Quarter of 2017-18 | 7.60% |

| third Quarter of 2017-18 | 7.80% |

| 2nd Quarter of 2017-18 | 7.80% |

| 1st Quarter of 2017-18 | 7.90% |

| 4th Quarter of 2016-17 | 8.00% |

| third Quarter of 2016-17 | 8.00% |

| 2nd Quarter of 2016-17 | 8.10% |

| 1st Quarter of 2016-17 | 8.10% |

| 2015-16 | 8.70% |

| 2014-15 | 8.70% |

| 2013-14 | 8.70% |

| 2012-13 | 8.80% |

| 1st Dec 2011 to thirty first March 2012 | 8.60% |

| 1st March 2003 to thirtieth Nov 2011 | 8% |

| 1st March 2002 to twenty eighth Feb 2003 | 9% |

| 1st March 2001 to twenty eighth Feb 2002 | 9.50% |

| fifteenth Jan 2000 to twenty eighth Feb 2001 | 11% |

| 1st April 1999 to 14th Jan 2000 | 12% |

| 1st April 1986 to thirty first Mar 1999 | 12% |

| 1985-86 | 10% |

| 1984-85 | 9.50% |

| 1983-84 | 9% |

| 1982-83 | 8.50% |

| 1981-82 | 8.50% |

| 1980-81 | 8% |

| 1979-80 | 7.50% |

| 1978-79 | 7.50% |

| 1977-78 | 7.50% |

| 1976-77 | 7% |

| 1975-76 | 7% |

| 1st Aug 1974 to thirty first Mar 1975 | 7% |

| 1st April 1974 to thirty first July 1974 | 5.80% |

| 1973-74 | 5.30% |

| 1972-73 | 5% |

| 1971-72 | 5% |

| 1970-71 | 5% |

| 1969-70 | 4.80% |

| 1968-69 | 4.80% |

The identical will be proven in a graphical method from the under chart.

You seen that in 1986 to 2000 interval was the golden period for PPF because the rate of interest was greater than 10%. Nonetheless, we should not ignore the inflation and rate of interest cycles additionally.

Conclusion – Although these days rate of interest modifications on a quarterly foundation and this rate of interest threat and liquidity are main considerations for the PPF, I nonetheless insist you utilize PPF as a debt a part of your objectives that are greater than or equal to your PPF maturity date.