Yesterday (November 29, 2023), the Australian Bureau of Statistics (ABS) launched the newest – Month-to-month Client Worth Index Indicator – for October 2023, which confirmed a pointy drop in inflation. This launch resolves a few of the uncertainty that arose when the September-quarter knowledge got here out final month, which confirmed a slight uptick. I analysed that knowledge launch on this weblog publish – Slight rise in Australian inflation fee pushed by components that don’t justify additional fee hikes (October 25, 2023) and concluded that the slight rise was not an indication of extra spending and would quickly resolve. Right now’s figures are the closest we have now to what’s truly occurring in the intervening time and present that the inflation fell from an annual fee of 5.6 per cent in September 2023 to 4.9 per cent in October. The trajectory is firmly downwards. As I present under, the one elements of the CPI which can be rising are both because of exterior components that the RBA has no management over and are ephemeral, or, are being attributable to the RBA fee rises themselves. The RBA boss was in Hong Kong this week attempting to justify the speed hikes by saying that Australian households are coping properly. Her evaluation is partial and ignores the large distributional variations arising from the rate of interest will increase. Justifying the unjustifiable!

Inflation continues to say no sharply in Australia

Whereas this knowledge got here out, the brand new RBA governor was swanning round Hong Kong telling the viewers at a so-called ‘Excessive degree convention’ that inflation was extreme in Australia and that regardless of the 11 fee hikes since Might 2022, Australian households have been nonetheless “in a very good place”.

I’m wondering if she has truly requested some households whether or not they have been in a very good place.

She additionally claimed that the RBA fee selections had impacted erratically and that:

There are distributional penalties, and we’re coping with the political economic system challenges of the distributional points related to elevating rates of interest

Who’s coping with it?

Not the RBA?

Their said objective is to make these ‘challenges’ worse by pushing up unemployment in order that round 140,000 extra employees are with out jobs.

And people job losses if the RBA has its approach will influence totally on the lower-income households who’re additionally the worst hit by the rate of interest will increase.

I wrote about that on this weblog publish – RBA desires to destroy the livelihoods of 140,000 Australian employees – a stunning indictment of a failed state (June 22, 2023).

The ABS Media Launch (November 29, 2023) – Month-to-month CPI indicator rose 4.9% yearly to October 2023 – famous that:

The 4.9 per cent enhance is down from 5.6 per cent in September and under the height of 8.4 per cent in December 2022 …

Probably the most vital contributors to the October annual enhance have been Housing (+6.1 per cent), Meals and non-alcoholic drinks (+5.3 per cent) and Transport (+5.9 per cent) …

The annual enhance in Rents is decrease than the rise of seven.6 per cent in September largely because of the enhance in Commonwealth Hire Help that took impact from 20 September 2023 and reduces rents for eligible tenants …

Electrical energy costs rose 10.1 per cent within the 12 months to October reflecting will increase in wholesale costs from annual value opinions in July 2023 …

Automotive gas costs have been 8.6 per cent increased in October in comparison with 12 months in the past, because of increased international oil costs. That is down from the annual enhance of 19.7 per cent in September.

So a number of observations:

1. All the key contributors are in decline.

2. The hire inflation is partly because of the RBA’s personal fee hikes as landlords in a decent housing market simply cross on the upper borrowing prices – so the so-called inflation-fighting fee hikes are literally driving inflation.

3. Not one of the different main drivers are delicate to interest-rate will increase, and are declining for causes unrelated tot he moentary coverage modifications.

4. The electrical energy value rises are because of insufficient regulation of the privateised energy corporations – a failing of presidency. I wrote about that on this latest weblog publish – Electrical energy community corporations revenue gouging as a result of authorities regulatory oversight has failed (November 22, 2023).

5. Observe that fiscal coverage enlargement – the Commonwealth Hire Help scheme helped cut back inflation fee and gave some aid to households – however not sufficient.

The Federal authorities may have achieved far more to alleviate the strain on households of those non permanent cost-of-living rises during the last two years.

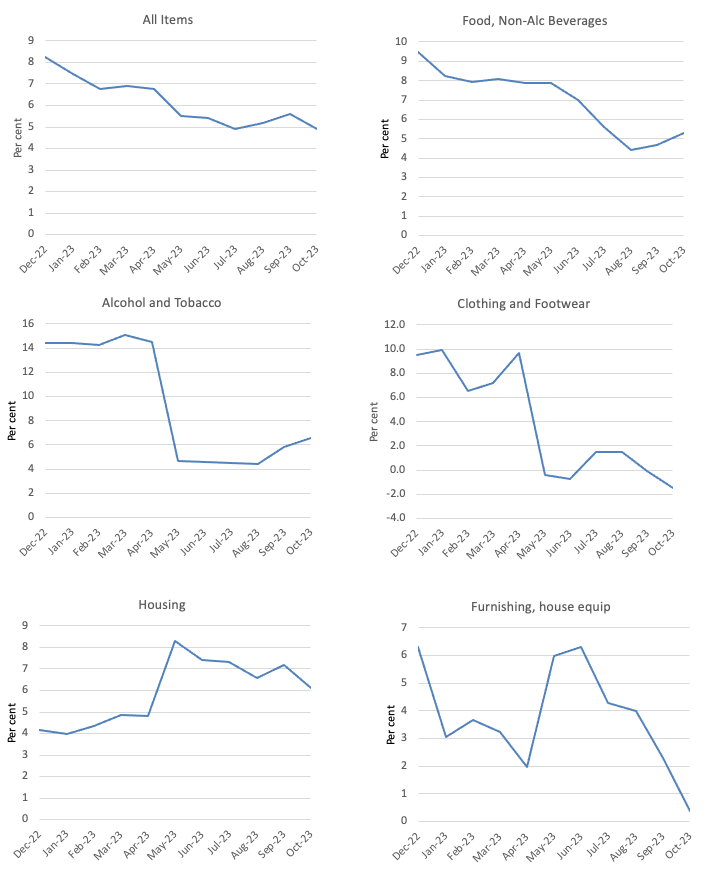

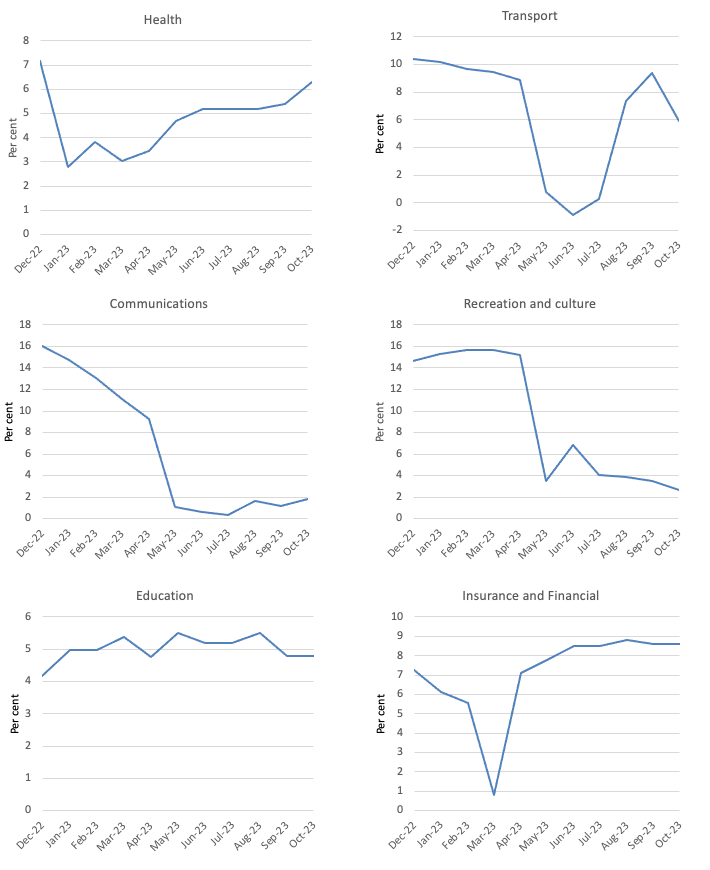

The most recent ABS knowledge (linked to within the introduction) reveals:

- The All teams CPI measure fell by 0.41 per cent and by 4.8 per cent during the last 12 months (down from 5.5 per cent).

- On an annual foundation, meals and non-alcoholic drinks fell by 0.2 factors.

- Clothes and footwear fell 1.5 factors.

- Housing rose 0.8 factors.

- Furnishings and family tools fell 1.5 factors.

- Well being fell 1.7 factors.

- Transport fell 0.9 factors.

- Communications fell 0.2 factors.

- Recreation and tradition fell 7.9 factors.

- Schooling fell 1.9 factors.

- Insurance coverage and Monetary Providers rose 0.9 factors.

So, vital falls in most main commodity teams.

Observe the rise in FIRE companies which is, partially, because of the banks gouging earnings.

The overall conclusion is that the worldwide components that have been chargeable for the inflation pressures are abating pretty rapidly because the world adapts to Covid, Ukraine and OPEC revenue gouging.

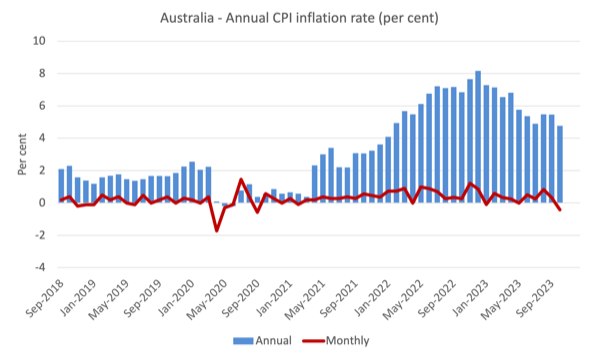

The subsequent graph reveals, the annual fee of inflation is heading in a single course – down and rapidly.

The blue columns present the annual fee whereas the purple line reveals the month-to-month actions within the All Gadgets CPI.

The subsequent graphs present the actions between December 2022 and October 2023 for the principle elements of the All Gadgets CPI.

Normally, most elements are seeing dramatic reductions in value rises as famous above and the exceptions don’t present the RBA with any justification for additional rate of interest rises.

Total, the inflation fee is declining as the provision components ease.

The RBA’s fictional NAIRU

In June 2023, the RBA governor (then deputy) claimed the so-called Non-Accelerating-Inflation-Fee-of-Unemployment (NAIRU) was 4.5 per cent and until the unemployment fee rose to that degree inflation would proceed to speed up.

This was only a easy utility of the mainstream textbook rubbish which says that if the unemployment fee is under the NAIRU then inflation accelerates, and, if the unemployment fee is above the NAIRU, then inflation will decline.

The NAIRU, in accordance with the logic defines the state the place inflation is secure.

I reject the logic, however let’s run with it to check its inner consistency.

On that foundation, even when we settle for there’s a definable NAIRU that may be measured in some way, the RBA governor’s narrative was plainly mistaken.

I wrote about that situation in additional element on this weblog publish (amongst others) – Mainstream logic ought to conclude the Australian unemployment fee is above the NAIRU not under it because the RBA claims (July 24, 2023).

The RBA has now revised their estimate of the NAIRU to 4.25 per cent.

The purpose is, in accordance with the NAIRU logic, if the unemployment fee is under the NAIRU then inflation ought to be accelerating and if the unemployment fee is above the NAIRU, then inflation ought to be decelerating.

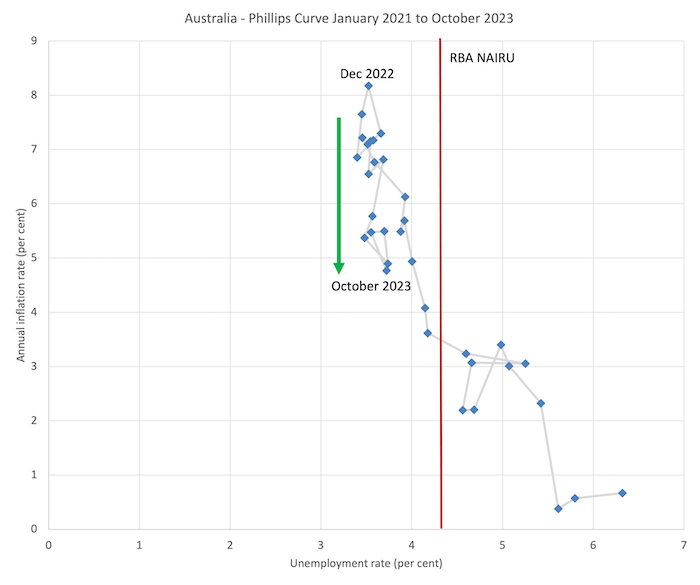

The info are proven within the graph under which is a Phillips curve graph from January 2021 (simply earlier than the inflation fee accelerated) to October 2023.

A Phillips curve graphs the connection between the unemployment fee (horizontal axis) and the inflation measure on the vertical axis.

In Australia’s case during the last 2 years, the state of affairs is fairly clear.

The unemployment fee has been very secure during the last 12 months however the inflation fee has been falling since final September (inexperienced arrow).

Which implies that logically, the NAIRU couldn’t be above the present unemployment fee and should be under it.

Which implies that the RBA’s insistence on placing 140,000 additional employees onto the unemployment scrap heap has no basis even within the theoretical construction they consider in.

The vertical purple line is the RBA’s NAIRU, which coincides with an inflation fee of simply over 3 per cent.

However at that inflation fee there’s a variety of unemployment charges proven – from 4.1 per cent to five.3 per cent (about) and if I used to be to do the econometric modelling to estimate the NAIRU formally, I’d get a large confidence interval inside which I couldn’t statistically discriminate – in different phrases the NAIRU estimates are ineffective for coverage.

The NAIRU estimates are simply instruments utilized by ideologues who need increased unemployment and extra bargaining energy to the companies.

The latest inflation peak was in December 2022 and it has been declining steadily since with a blip in April 2023.

However have a look at the vary of the unemployment fee inside which that decline has been going down?

Very slender.

So the NAIRU can’t be at 4.25 per cent if on the present unemployment fee (3.7 per cent) inflation is systematically declining.

It should, in a logical sense, be decrease than 3.7 per cent.

Conclusion

The issue with the RBA narrative is that it refers to solely a subset of the expenditure classes that family face.

The info that the RBA has cited to justify its declare that households have ample monetary buffers (from financial savings) to take care of the additional mortgage funds exclude bills referring to schooling and medical insurance, each main gadgets for many households.

And there estimates are based mostly on the typical, when in actual fact there isn’t any ‘common’!

It’s clear that decrease earnings households are going through huge monetary pressure – estimates of the proportion of households which have earnings under their present prices is round 15 per cent.

On the opposite facet, are the wealth holders, largely older individuals, who personal their very own dwelling and have interest-sensitive earnings or shares within the banks.

That group is partying at current.

These distributional variations are necessary however largely ignored within the RBA rhetoric that it pumps out to justify its unjustifiable selections.

Additional, yesterday’s knowledge places paid to the RBA declare that home wages development is now threatening value stability.

Despite the fact that there was some welcome development in nominal wages within the newest knowledge launch from the RBA, inflation is falling pretty rapidly.

I coated that knowledge launch on this weblog publish – Australia – stronger nominal wages development however nonetheless under the inflation fee – no justification for intentionally rising unemployment (November 23, 2023).

That’s sufficient for right this moment!

(c) Copyright 2023 William Mitchell. All Rights Reserved.