Within the final two weeks, I’ve heard this market described as “frustratingly impartial”, “decidedly sideways”, “caught”, and my private favourite, the “sloppy uneven” part. So how does the market breakout of this sideways interval and transfer into a brand new bullish or bearish part?

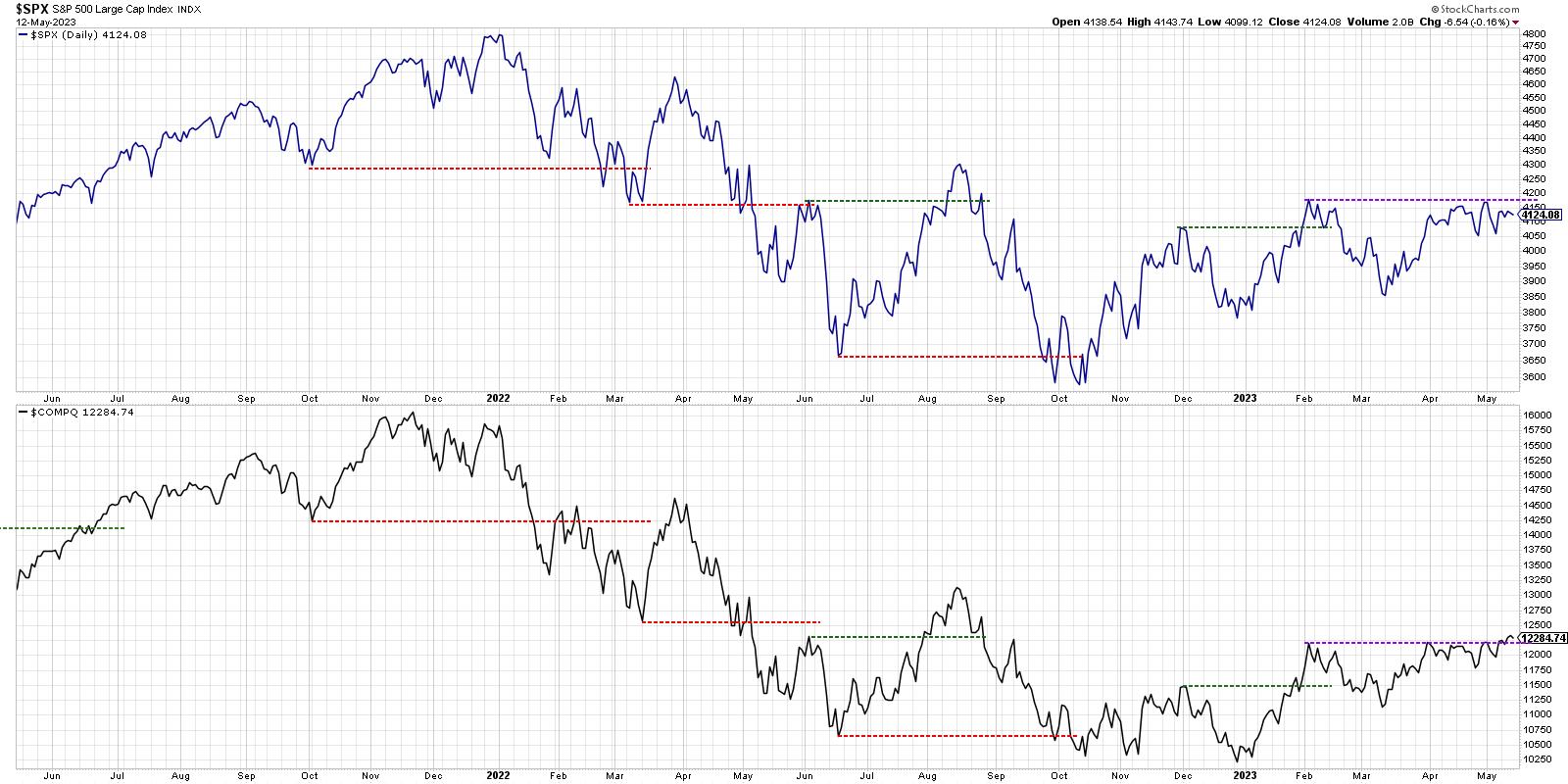

It begins with the S&P 500 and Nasdaq Composite and what I name the New Dow Idea.

What a Breakout Might Look Like

Now, there are extra refined strategies for gauging Dow Idea alerts, however I are likely to maintain issues tremendous easy. When each the S&P 500 and Nasdaq Composite are making a brand new swing excessive, that may be a confirmed bullish sign. When both index makes a brand new swing excessive, and the opposite index doesn’t verify that new swing excessive, that may be a bearish non-confirmation. When each the S&P 500 and Nasdaq Composite are making a brand new swing low, there is a confirmed bearish sign. When both index makes a brand new swing low, and the opposite index doesn’t verify that new swing excessive, that may be a bullish non-confirmation.

We are able to see that this week the Nasdaq Composite did certainly make a excessive for 2023, lastly pushing above its February peak. The S&P 500, even with a fierce rally into Friday’s shut, nonetheless has not damaged out to a brand new swing excessive.

If the S&P 500 would shut above 4200 in some unspecified time in the future subsequent week, that may create what we listed above as a confirmed bullish sign. What if the SPX doesn’t shut above 4200? Then we might have a bearish non-confirmation and a probable retest of the March low.

Additional Affirmation From Market Breadth

Now the difficulty with our growth-oriented, cap-weighted benchmarks is that they’re very skewed to a comparatively small variety of mega cap shares in sectors like know-how and communication providers.

We have been speaking slender management and questionable breadth situations for some time now, and John Murphy included it as a key bullet level in his current market observe.

If we take a look at the advance-decline strains by cap tiers, you may discover an enormous distinction between situations for the biggest vs. the smallest names within the fairness area.

Under the S&P 500 value development, you may see three knowledge collection which characterize the cumulative advance-decline strains for giant caps, mid caps, and small caps. Word how the massive cap A-D line is testing its February excessive, just like the S&P 500 itself. The mid cap A-D line is effectively off its February excessive, and simply broke beneath its 50-day transferring common this week. On the backside, you may see that the small cap advance-decline line is testing its March low.

Speak about three very totally different takes on market breadth!

Whereas our mega-cap dominated benchmarks can and do transfer greater based mostly on the power of the mega cap commerce, the weak spot within the smaller shares on the market suggests much less of a “risk-on” setting, and extra of a “getting massive and defensive” really feel.

The bear case from right here would begin with the small cap A-D line making a brand new low for 2023, in addition to the massive cap breadth line not pushing above its February excessive.

Investor Sentiment and Financial Development

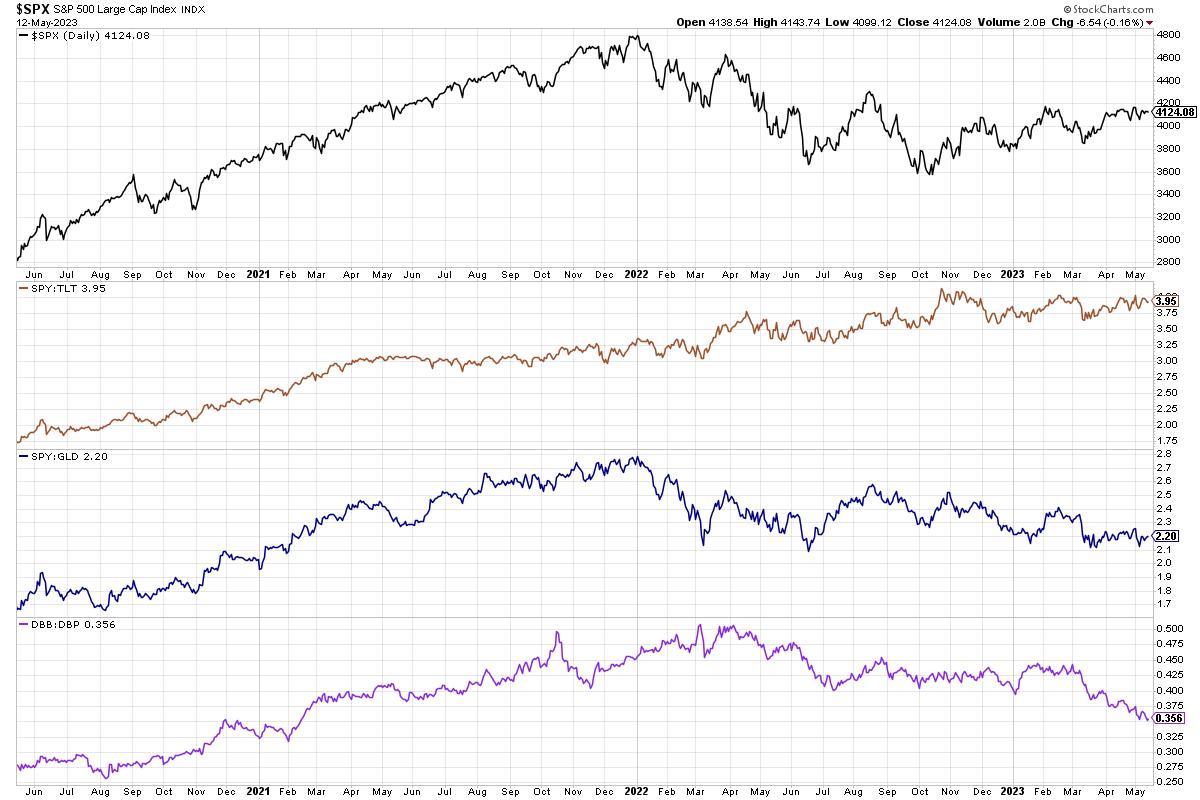

Our ultimate chart as we speak addresses the connection between the fairness markets and different asset lessons. Right here we see the S&P 500 on the high, adopted by three key ratios that present fascinating insights into market sentiment and financial outlooks.

The primary ratio is shares vs. bonds, utilizing the SPY and TLT ETFs. Word how this ratio was in a transparent uptrend for about three years, beginning simply after the 2020 market low. It positively paid to personal shares over bonds from 2020 by means of 2022.

Now take a look at the final six months, and you will see how shares and bonds have been just about a wash since October of final 12 months. That is proper, proudly owning shares or bonds would given you fairly related returns, even with equities rallying strongly off their October lows.

The following panel down reveals shares vs. gold, or what I consider as “paper vs. rocks”. Now within the rocks-scissors-paper problem I usually discover myself in with my seven-year-old son, paper covers rocks. However within the monetary markets in 2023, rocks have carried out a lot better because of the power in gold and valuable metals. So you’ve got been a lot better off proudly owning gold over shares or bonds because the finish of 2021.

On the backside, we have now two ETFs of which you’ll be a bit much less acquainted. Right here, we’re evaluating base metals (DBB) vs. valuable metals (DBP). When economies are rising, you want a number of copper and aluminum and different sensible supplies to construct cities and different issues. When the financial system is weaker, valuable metals are likely to thrive, as they’re thought-about an excellent retailer of worth and are usually as recession-proof as something could be. And, after all, weaker economies imply much less demand for base metals.

So what does it imply that this ratio has been trending decrease over the past 12 months? It definitely doesn’t imply that the financial system is doing effectively, and arguably it signifies that the actions taken by the Fed to boost charges and sluggish the financial system has had its supposed impact.

Can shares transfer greater whereas this ratio goes decrease? After all. However simply as we have mentioned relating to small-cap inventory efficiency and offensive vs. defensive sectors, I would really feel a lot better about upside potential if ratios like this have been trending greater slightly than decrease!

Wish to digest that final chart in video format? Simply head over to my YouTube channel!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any method characterize the views or opinions of every other individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers reduce behavioral biases by means of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor choice making in his weblog, The Aware Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing threat by means of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and knowledge visualization to establish funding alternatives and enrich relationships between advisors and shoppers.

Be taught Extra