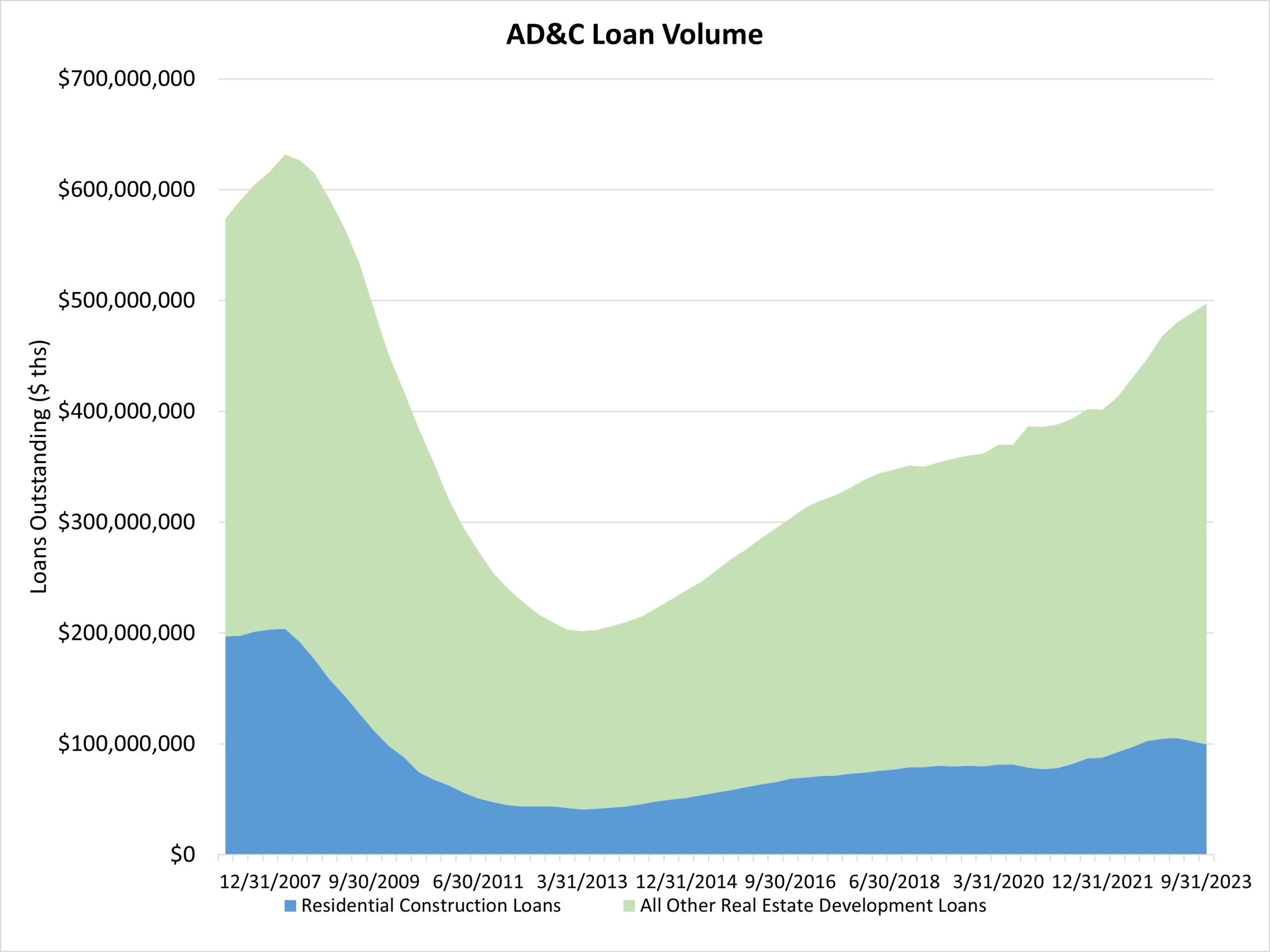

The quantity of whole excellent acquisition, growth and development (AD&C) loans posted a decline in the course of the third quarter of 2023 as rates of interest elevated and monetary circumstances tightened.

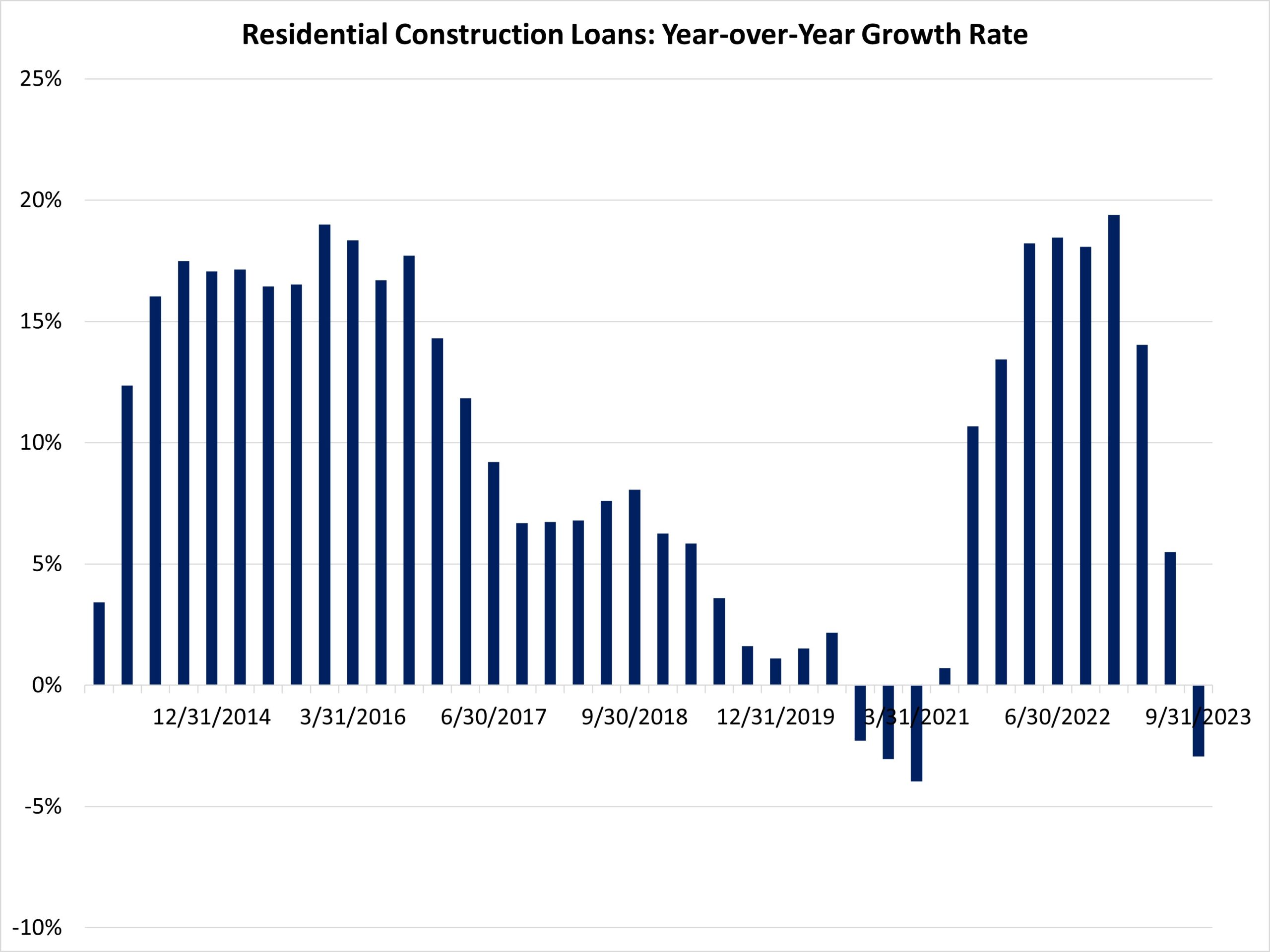

The quantity of 1-4 unit residential development loans made by FDIC-insured establishments declined by 2.8% in the course of the third quarter. The quantity of loans declined by $2.9 billion for the quarter. This mortgage quantity retreat locations the full inventory of house constructing development loans at $99.6 billion, off a post-Nice Recession excessive set in the course of the first quarter.

On a year-over-year foundation, the inventory of residential development loans is down 2.9%. This contraction for development financing is a key motive house builder sentiment has moved decrease in current months. Nonetheless, for the reason that first quarter of 2013, the inventory of excellent house constructing development loans is up 144%, a rise of greater than $58 billion.

It’s value noting the FDIC knowledge symbolize solely the inventory of loans, not modifications within the underlying flows, so it’s an imperfect knowledge supply. Lending stays a lot diminished from years previous. The present quantity of current residential AD&C loans now stands 51% decrease than the height degree of residential development lending of $204 billion reached in the course of the first quarter of 2008. Different sources of financing, together with fairness companions, have supplemented this capital market lately.

The FDIC knowledge reveal that the full decline from peak lending for house constructing development loans continues to exceed that of different AD&C loans (nonresidential, land growth, and multifamily). Such types of AD&C lending are off a smaller 9% from peak lending. For the third quarter, these loans posted a 2.9% enhance.