The cryptocurrency market has began 2023 on a optimistic observe, rebounding to pre-FTX crash ranges and witnessing a surge in Bitcoin costs, virtually reaching June 2022 ranges. With a resurgence of funding exercise in Web3 and a surge in token gross sales, the market appears to have overcome the challenges of the previous 12 months.

Q1 2023 confronted some challenges primarily from the normal monetary sector somewhat than throughout the crypto market. Actually, the banking disaster has additional bolstered the adoption of Bitcoin amongst buyers, highlighting its capacity to climate monetary uncertainty.

Because the world grapples with international monetary market uncertainty, it stays but to be seen how the crypto market will carry out. Nonetheless, it’s more and more clear that cryptocurrencies like Bitcoin supply a viable various to conventional finance techniques.

This report will delve into the Q1 efficiency of DeFi in 2023 and supply insights into its future potential.

So, let’s dive in and discover the crypto ecosystem’s thrilling developments!

Key Takeaways

- DeFi’s TVL progress continues, reaching a formidable $83.3 billion. Lido Finance is now the most important DeFi protocol, indicating a rising demand for LPPs.

- Cardano’s DeFi TVL skilled a exceptional 172% surge, whereas its native coin, ADA, recorded a major value acquire of 54%.

- The ARB airdrop’s launch on March 23 led to a major surge in every day transactions on the Arbitrum blockchain. The height every day transaction quantity reached 2,728,907, surpassing each Ethereum and Optimism.

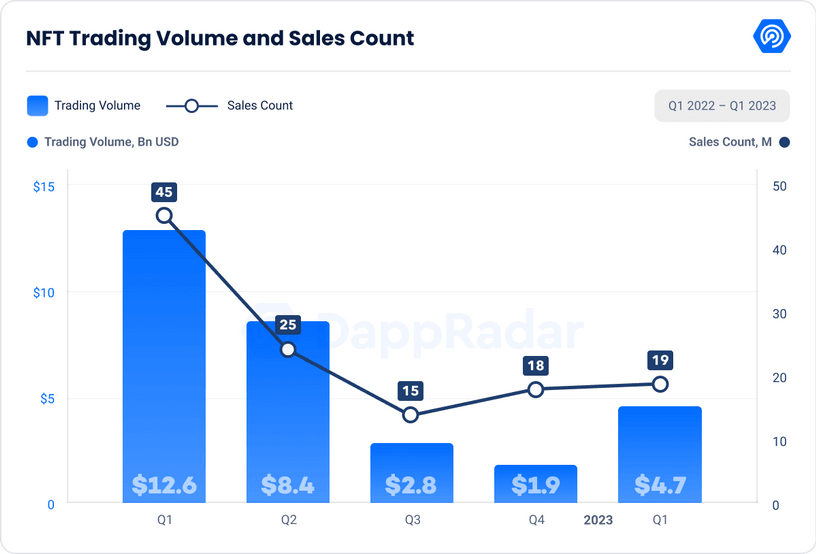

- The NFT market continues thriving, registering $4.7 billion in buying and selling quantity and 19.4 million in gross sales depend. Polygon noticed a 124% improve in buying and selling quantity and a 157.39% improve in gross sales depend, pushed by the recognition of its NFT collections.

- In January 2023, OpenSea emerged as the highest performer within the NFT market, with a 66.58% surge in buying and selling quantity, amounting to $495 million. This spectacular determine accounted for 58% of the NFT market’s whole buying and selling quantity, establishing OpenSea’s market dominance.

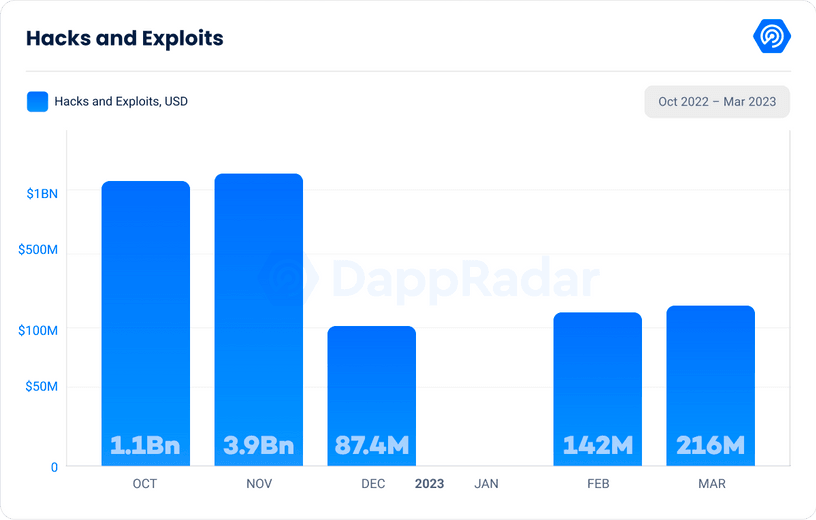

- In Q1 2023, the crypto business skilled a major lower within the lack of funds ensuing from hacks and exploits. In comparison with the earlier quarter’s staggering $5 billion, the quantity misplaced was a mere $373 million, representing a exceptional 92.60% discount.

Bull Market on the Horizon

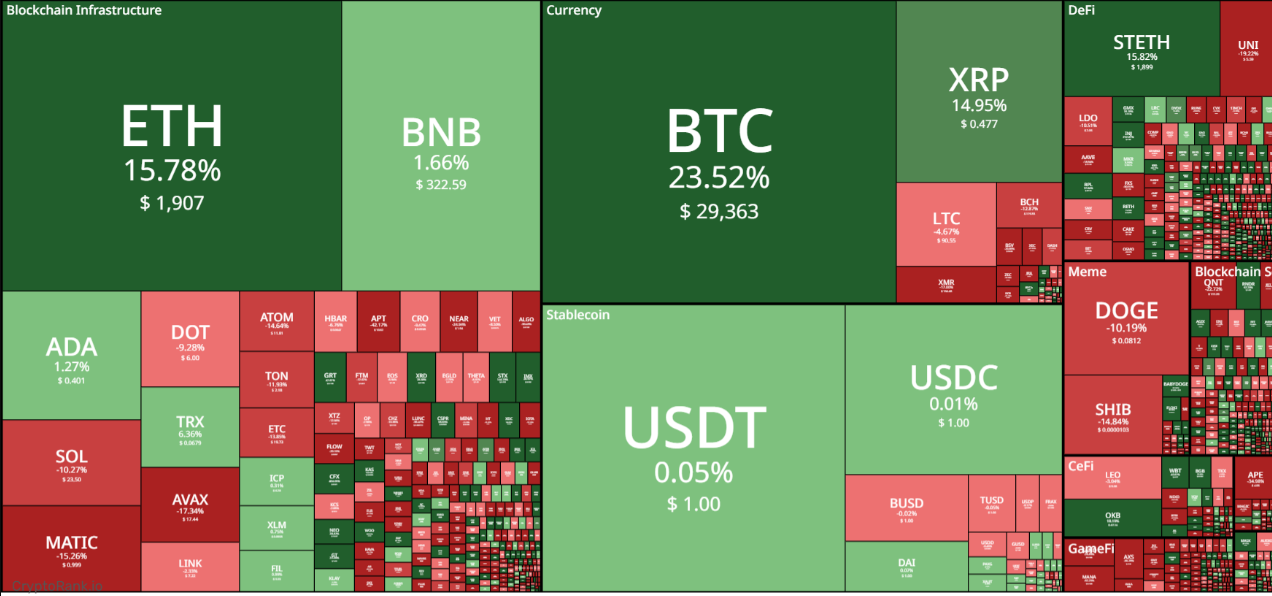

The beginning of 2023 marked a pivotal level for Bitcoin, as its worth surged following weeks of low volatility. Regardless of destructive occasions such because the Genesis drama, January proved to be a profitable month for the cryptocurrency market as an entire. Whereas February noticed a mean efficiency, March witnessed an upsurge in varied metrics, signaling new heights for the business.

Bitcoin emerged because the clear outperformer among the many high 10 initiatives of Q1, with a number of notable top-100 initiatives additionally making vital positive factors. Solana, which had a tough Q3 as a result of its affiliation with FTX, skilled a 109% improve in Q. Lido additionally carried out impressively, with a 134% improve. Lastly, Aptos confirmed excellent progress, with a exceptional 230% improve on this quarter.

The DeFi Comeback: Exploring the Resurgence of Decentralized Finance

Because the market rebounds, DeFi can also be exhibiting indicators of restoration. Nonetheless, DeFi’s Whole Worth Locked (TVL) progress has been slower in comparison with the general market as a result of altcoins lagging behind Bitcoin of their progress. Nonetheless, the emergence of recent developments is a optimistic signal for DeFi.

Liquid staking has emerged as a brand new pattern in DeFi as a key ingredient of Proof-of-Stake networks and a major earnings supply for validators and delegators. The upcoming Ethereum improve, Shapella, will allow staked ETH withdrawals, additional growing liquid staking’s reputation. Decentralized liquid staking suppliers like Lido and Rocket Pool have gained reputation amongst DeFi customers as a result of providing by-product cash pegged to the quantity of staked cash.

The newest DeFi market information reveals that liquid staking protocols have now surpassed lending and borrowing protocols when it comes to mixed TVL, making them the second-largest after DEXs. Whereas there are 759 decentralized trade (DEX) protocols with a complete worth locked (TVL) of $19 billion, there are solely 78 different protocols with a mixed TVL of over $16 billion.

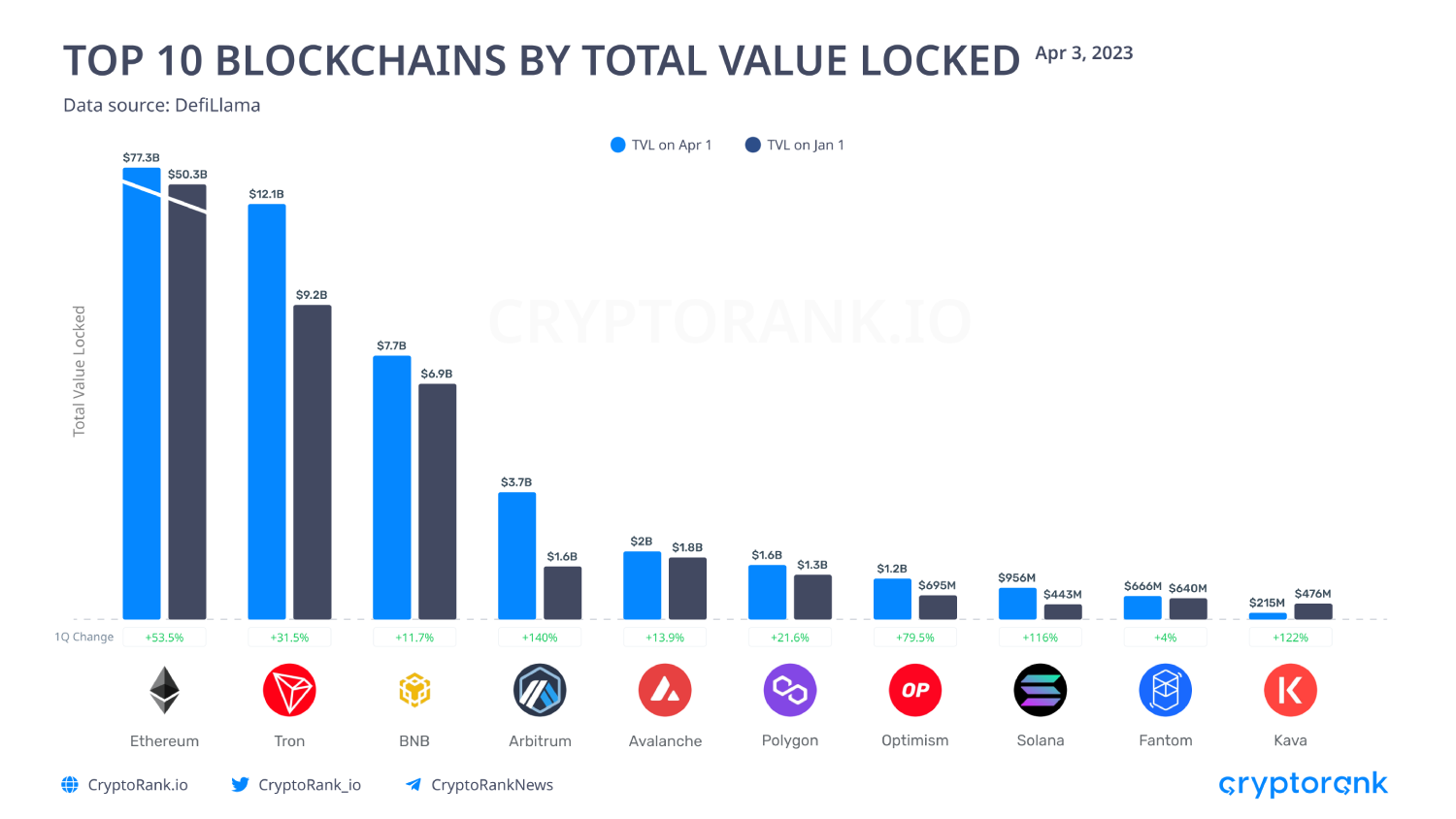

Relating to quantitative indicators of DeFi’s restoration, the TVL has elevated by virtually 40% because the starting of the 12 months. Whereas Ethereum continues to be the top-performing blockchain, Arbitrum, Solana, and Optimism skilled a major improve in TVL throughout Q1 2023.

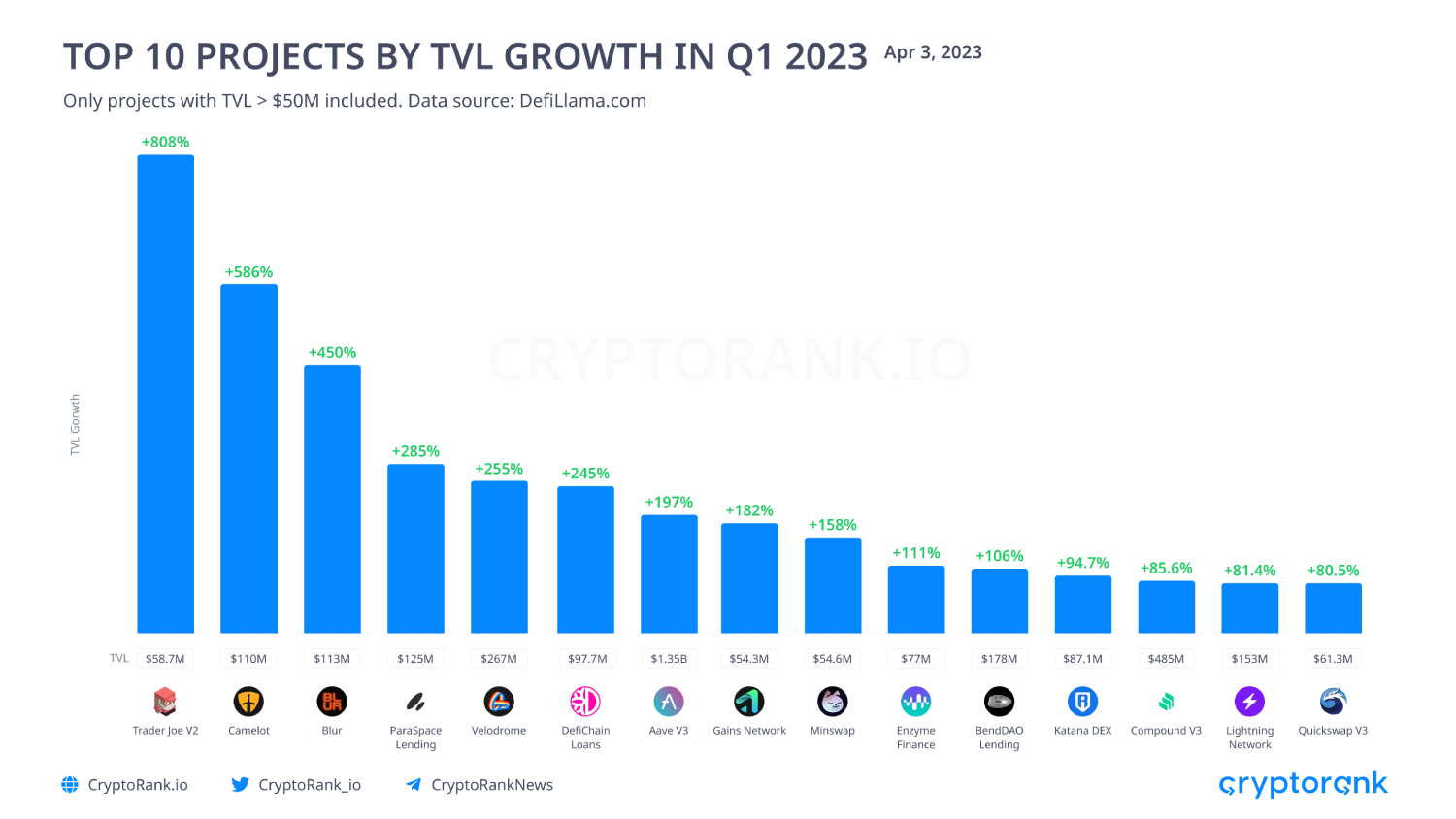

In Q1 2023, some protocols that launched on new networks noticed a notable improve in TVL and garnered vital consideration. Layer 2 expertise has performed an important position in driving the substantial surge in TVL for protocols corresponding to Camelot, Velodrome, and Positive aspects Community. The Lightning Community protocol has proven exceptional progress among the many high 15 protocols, primarily fueled by the growing use of Bitcoin as a cost choice.

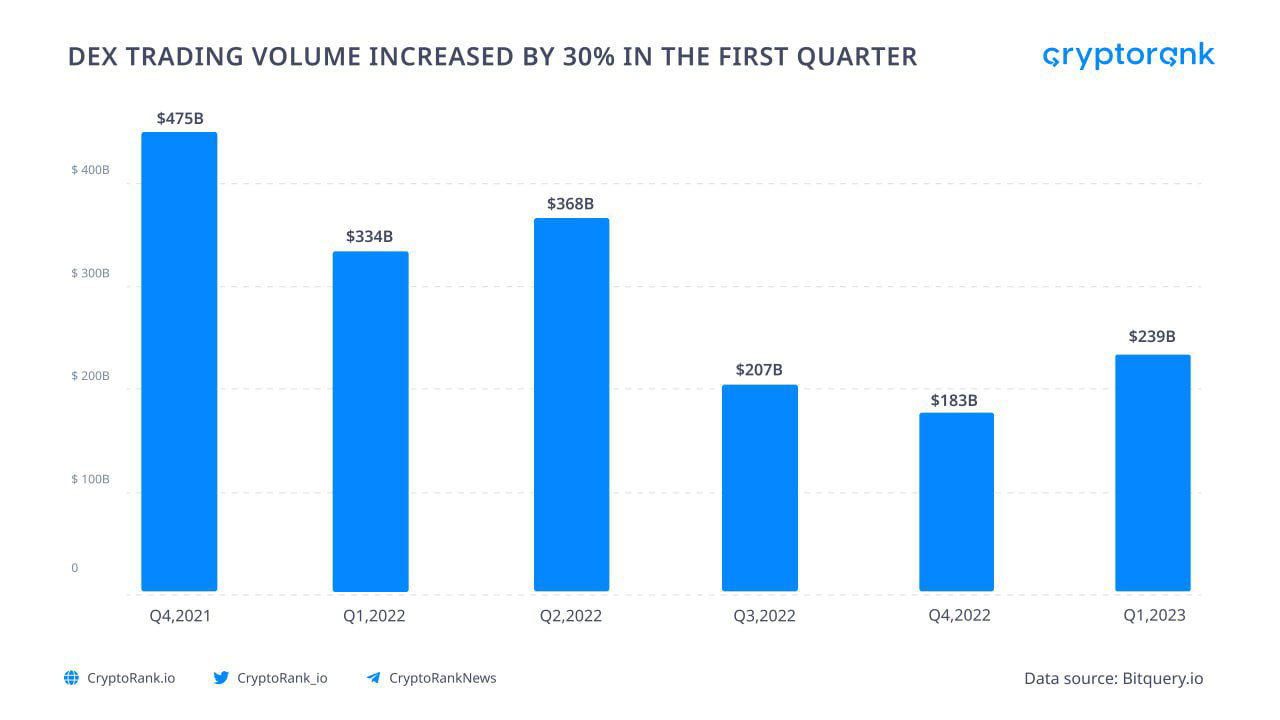

DEX buying and selling quantity confirmed a exceptional improve of practically 30% after two consecutive quarters of decline. The DEX/CEX ratio additionally elevated, nearing November 2022 ranges. Within the present market circumstances, DEXs are in a positive place to keep up their progress trajectory as a result of components corresponding to low fuel charges and elevated consciousness amongst Web3 customers.

Regardless of the DEX/CEX ratio nonetheless being 4% under the all-time excessive of January 2022, the rising reputation of blockchain may propel this metric to new heights sooner or later.

Layer 2 Options: The New Frontier of Blockchain Scaling

2022 noticed a major improve within the adoption of Layer 2 blockchains. In 2023, this pattern is predicted to achieve new heights, because the broader crypto neighborhood acknowledges the potential advantages of those options.

Optimism gained vital public consideration by means of its substantial airdrop. Later that 12 months, Arbitrum, an optimistic rollup, launched the Arbitrum Odyssey, incentivizing customers to interact with the community. This system proved to be so in style that it exceeded the capability of the community. The launch of L2 blockchains was well timed and well-received, providing customers all Ethereum options however with quicker transaction occasions, decrease prices, and elevated capability.

Arbitrum gained vital traction in H2 2022, with a number of main initiatives being launched on the community. This 12 months, the excitement round Arbitrum’s airdrop offered the proper alternative for different initiatives to launch their mainnets and testnets.

Following the ARB airdrop, zkSync launched the primary mainnet of zkEVM, referred to as zkSync Period. This launch garnered vital consideration and resulted in a surge in transaction volumes.

A number of days later, Polygon launched its much-anticipated zkEVM as a mainnet beta. A number of different Layer 2 initiatives are additionally garnering curiosity not solely from the crypto neighborhood but additionally from main enterprise capital corporations.

Numerous firms have been following within the footsteps of Polygon by increasing zero-knowledge applied sciences and growing their very own blockchains. For instance, ConsenSys, a major participant within the crypto business, has not too long ago launched “Linea,” its public testnet for zkEVM.

Coinbase has additionally launched its L2 community, ”Base” – a reminder that we’re nonetheless within the early phases of Layer 2 adoption, with many extra progressive rollups to return. The race for growing higher Layer 2 options continues because the crypto neighborhood strives to reinforce the scalability and performance of blockchain networks.

NFT Gross sales Skyrocket to $19.4 Million

The NFT market witnessed a sturdy uptick in Q1, displaying a exceptional 137.04% surge in buying and selling quantity. This record-breaking feat translated right into a whopping $4.7 billion in whole volumes, a staggering quantity not seen since Q2 2022. NFT gross sales reached a noteworthy milestone of $19.4 million in Q1 2023, showcasing an 8.56% improve from the earlier 2022 quarter. These figures point out the sustained and sturdy progress of NFTs within the present market, bolstered by the growing curiosity of mainstream buyers and establishments.

Inflated by the Blur token farming interval, the NFT market skilled a dip in March, with a 15.65% lower in buying and selling quantity in comparison with the earlier month. As to the variety of NFT gross sales, they remained comparatively secure. A complete of two.7 million NFTs had been offered, declining by solely 4.63%, in comparison with the earlier month.

Trying on the greater image, Q1 2023 was a hit for the NFT market, with a complete of 19.4 million NFTs offered, representing a rise of 8.56% from the final 2022 quarter.

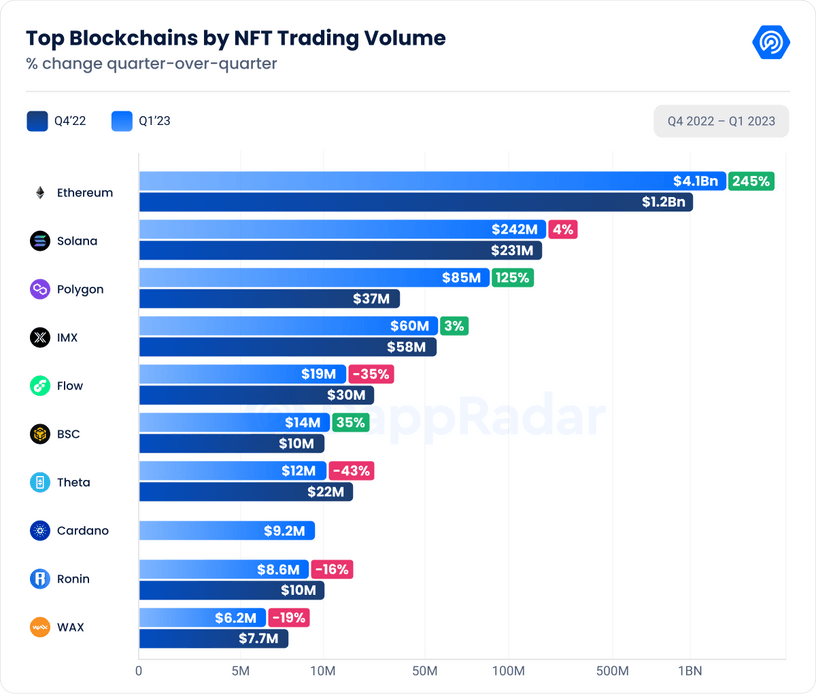

Ethereum maintained its stronghold within the NFT market, commanding a market share of 89.50% by quantity. In Q1 2023, Ethereum’s quarterly buying and selling quantity surged by 245.43%, reaching a formidable $4.1 billion.

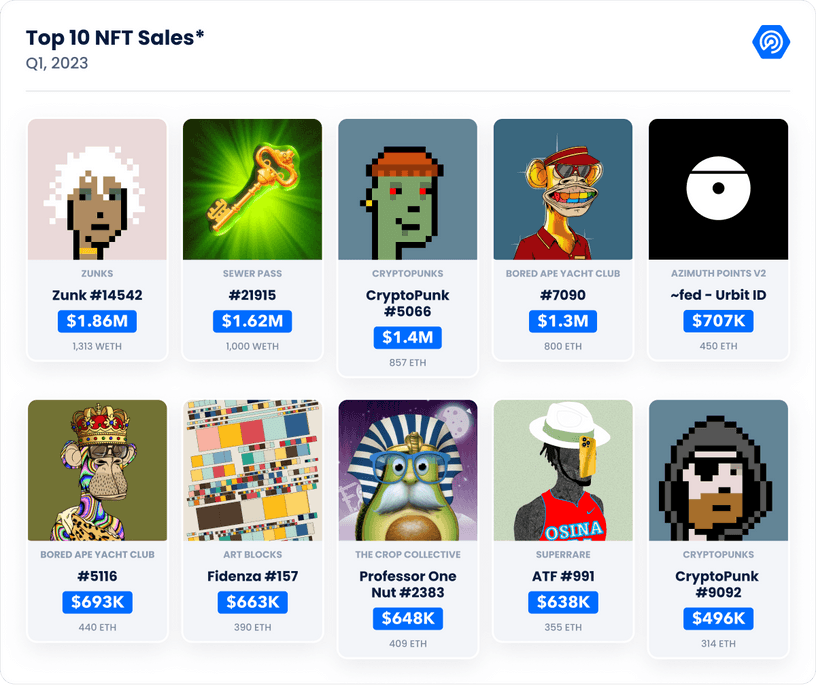

The extremely in style CryptoPunks assortment remained a top-performing asset in March, with a buying and selling quantity of $241 million, a rise of 1,214% from the earlier month. Yuga Labs NFT collections have emerged as a significant participant within the Ethereum market, commanding a 38.61% share of Ethereum’s NFT quantity and 34.55% of the whole NFT business.

Solana made a stunning entry into the NFT market by taking the second spot in buying and selling quantity, with $242 million and a 4.55% improve from the earlier quarter. The success of Solana’s NFT protocol is essentially attributed to the Monkey Kingdom assortment, with its buying and selling quantity doubling from February to March, reaching $7.9 million. In December 2022, the 2 hottest NFT collections on Solana introduced their plans to bridge to Ethereum and Polygon, which was a major milestone for the blockchain. The profitable launch of the y00ts sale on Polygon was introduced on March twenty seventh by the co-founders of DeGods and y00ts. The occasion marked a major milestone within the implementation of the bridge for one of many collections.

Polygon has been steadily gaining reputation within the NFT market. It had a formidable begin to the 12 months, with a buying and selling quantity of $29.8 million in March, regardless of a 24.20% lower from the earlier month. When trying on the quarterly information, the blockchain recorded a exceptional 125.04% improve in buying and selling quantity, totaling $85 million in Q1 2023. This surge in exercise might be attributed to Polygon’s quick transaction occasions and low charges, which make it a pretty choice for NFT creators and merchants. As well as, Binance NFT, the non-fungible token arm of Binance, added help for the Polygon community in its market, additional boosting its reputation amongst NFT fans.

DApp Business Overview

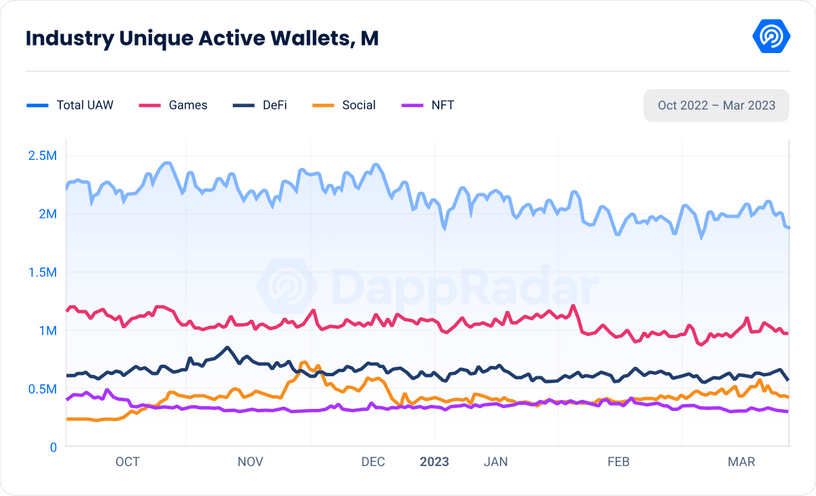

Following a dynamic quarter within the decentralized utility (DApp) business, the every day Distinctive Energetic Wallets (dUAW) interacting with decentralized functions decreased by 9.7% in comparison with the earlier quarter, with a mean of 1,735,570 wallets linked to DApps every day. Nonetheless, regardless of this total decline, sure classes and blockchains have demonstrated progress.

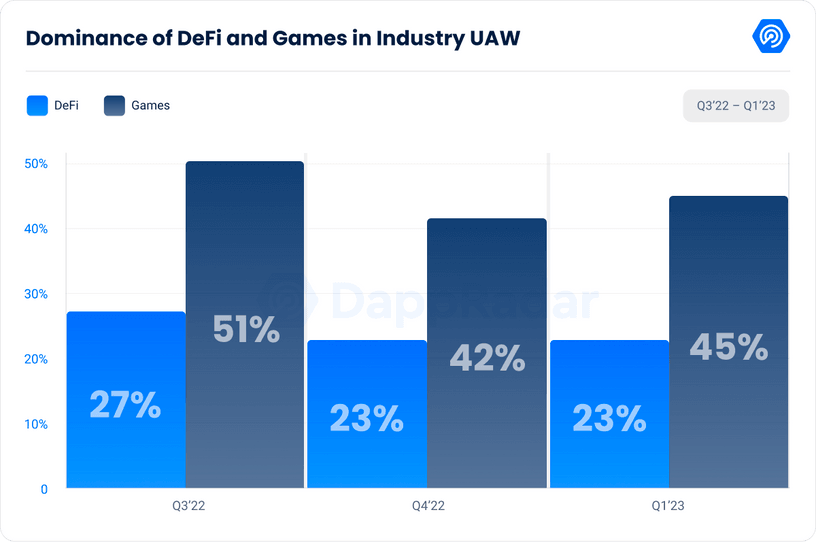

The blockchain gaming class stays the dominant vertical within the DApp business, accounting for its 45.6%, with a mean of 791,474 every day Distinctive Energetic Wallets (dUAW) in Q1, a decline of 8.58% in comparison with the earlier quarter. In the meantime, DeFi had a mean of 399,522 dUAW in Q1 2023, representing a decline of 14.73% from the earlier quarter, however nonetheless holding a 23% dominance over the business.

Social DApps have emerged as a preferred vertical, with a mean of 210,644 dUAW in Q1 2023, a lower of 4.9% from the earlier quarter however a formidable progress of two,250% since Q3 2022. Presently, social DApps account for 12% of the on-chain exercise tracked by DappRadar.

In Q1 2023, NFT DApps, comprising marketplaces, recorded a mean of 139,350 every day Distinctive Energetic Wallets (dUAW), accounting for 8% of pockets exercise. This displays a 0.2% improve from the earlier quarter and marks a notable surge from the 6% dominance noticed in This autumn 2022.

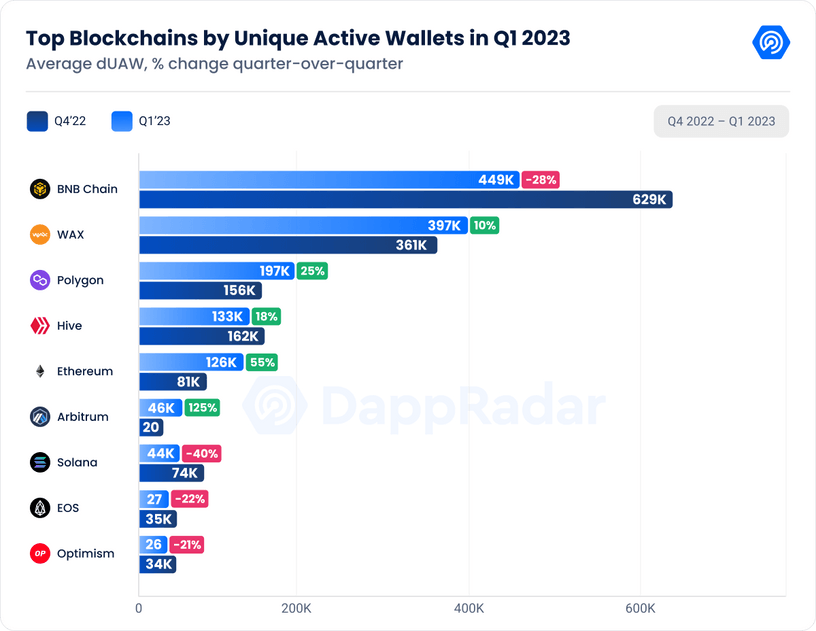

On this quarter, BNB Chain stays essentially the most lively blockchain with a mean of 449,543 every day Distinctive Energetic Wallets (dUAW), nonetheless an 28.62% lower from the earlier quarter. Wax is the following most lively blockchain, with a rise of 9% over the previous three months, averaging 397,273 dUAWs. In the meantime, Polygon skilled a robust quarter and noticed its every day Distinctive Energetic Wallets rise by 25.93% to achieve a mean of 197,343.

Arbitrum was the highest performer of the quarter, with a formidable improve of 125.83% with a mean of 46,071 dUAWs as a result of Arbitrum airdrop in March. Later on this report, we’ll delve deeper into these figures and discover the Arbitrum ecosystem.

Blockchain Gaming’s Dominance In Q1 2023

The blockchain gaming business has been experiencing a gradual surge over the previous few years, and this pattern continued in Q1 2023. Whereas the variety of every day distinctive lively wallets (dUAW) interacting with gaming DApps on-chain decreased by 3.33% in March in comparison with February, the business’s total dominance elevated up to now quarter.

Nonetheless, it’s value noting that the business continues to be in its nascent phases and is in steady growth. Regardless of the lower in dUAW numbers, blockchain gaming’s dominance elevated from 42.87% in This autumn of 2022 to 45.60% in Q1 of 2023, indicating a bullish signal. This implies blockchain gaming’s rising significance for the Web3 ecosystem.

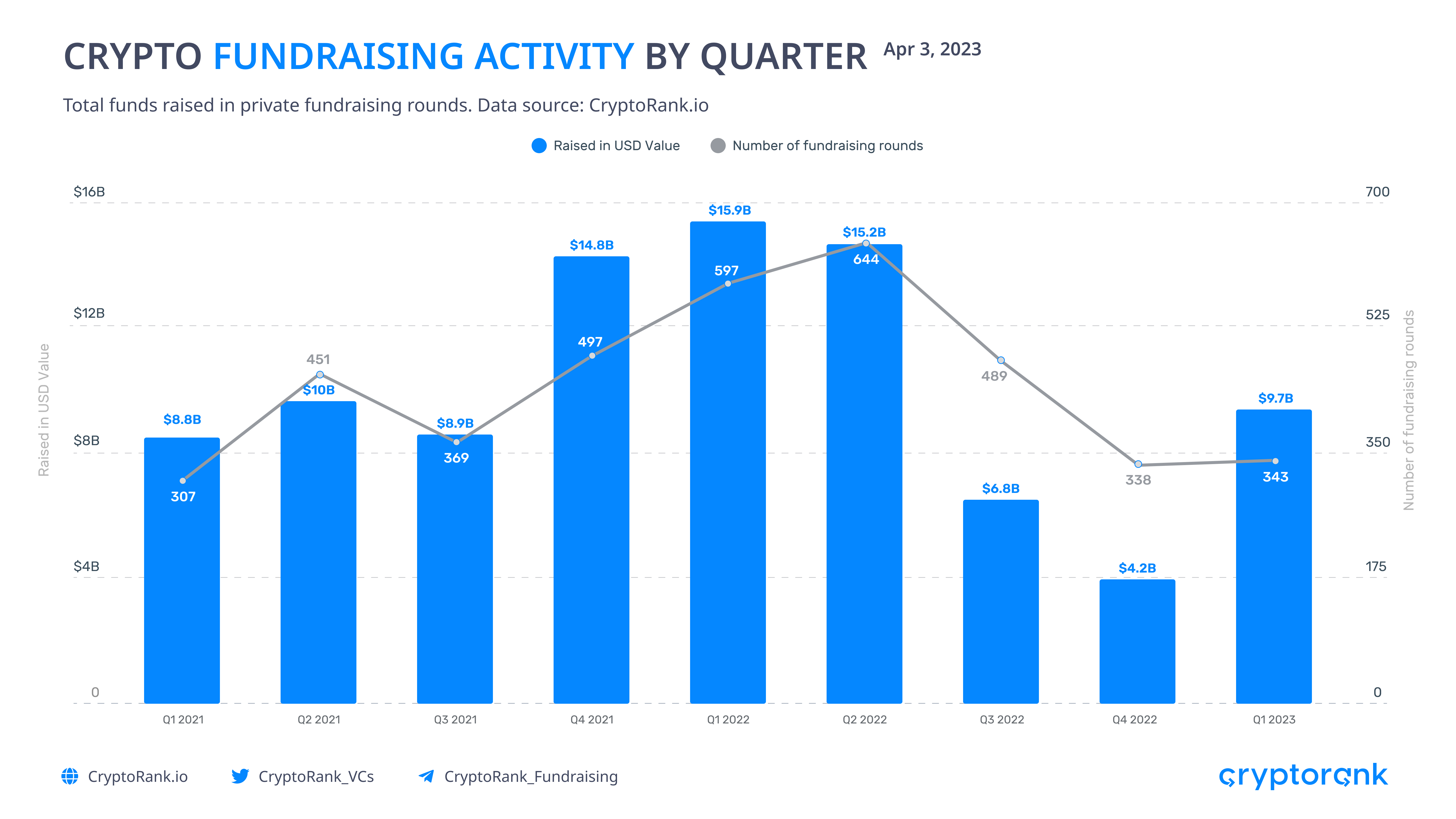

Fundraising’s Upward Development within the Crypto Market

The bullish pattern within the crypto market has led to a surge in fundraising actions. Enterprise capitalists and token sale launchpads are fast to capitalize on this chance as extra buyers have gotten conscious of the crypto business’s potential.

Following the FTX collapse, there was a major drop in fundraising exercise as a result of shutdown of Alameda and a scarcity of funding turnover. Nonetheless, fundraising exercise picked up in January, with an honest progress fee in comparison with December. March recorded even higher outcomes, indicating a optimistic pattern within the business.

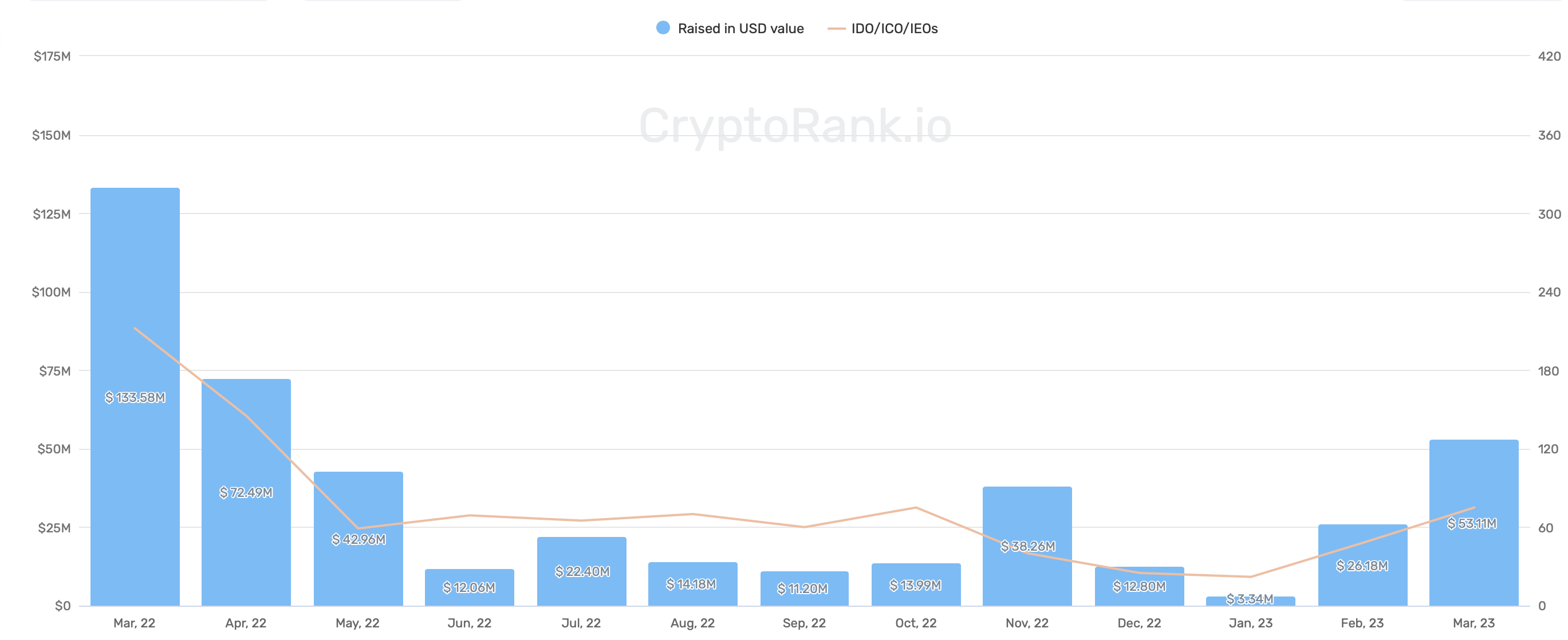

The crypto market has witnessed a shift in direction of infrastructure and repair initiatives providing sensible functions. Within the public fundraising sector, there was a resurgence of token sale exercise with profitable launches in February 2023. This optimistic momentum has continued into March, with month-to-month fundraising totals surpassing these of Could 2022.

This encouraging pattern displays the rising confidence of buyers within the crypto area and highlights the potential for promising initiatives to safe funding within the present market local weather.

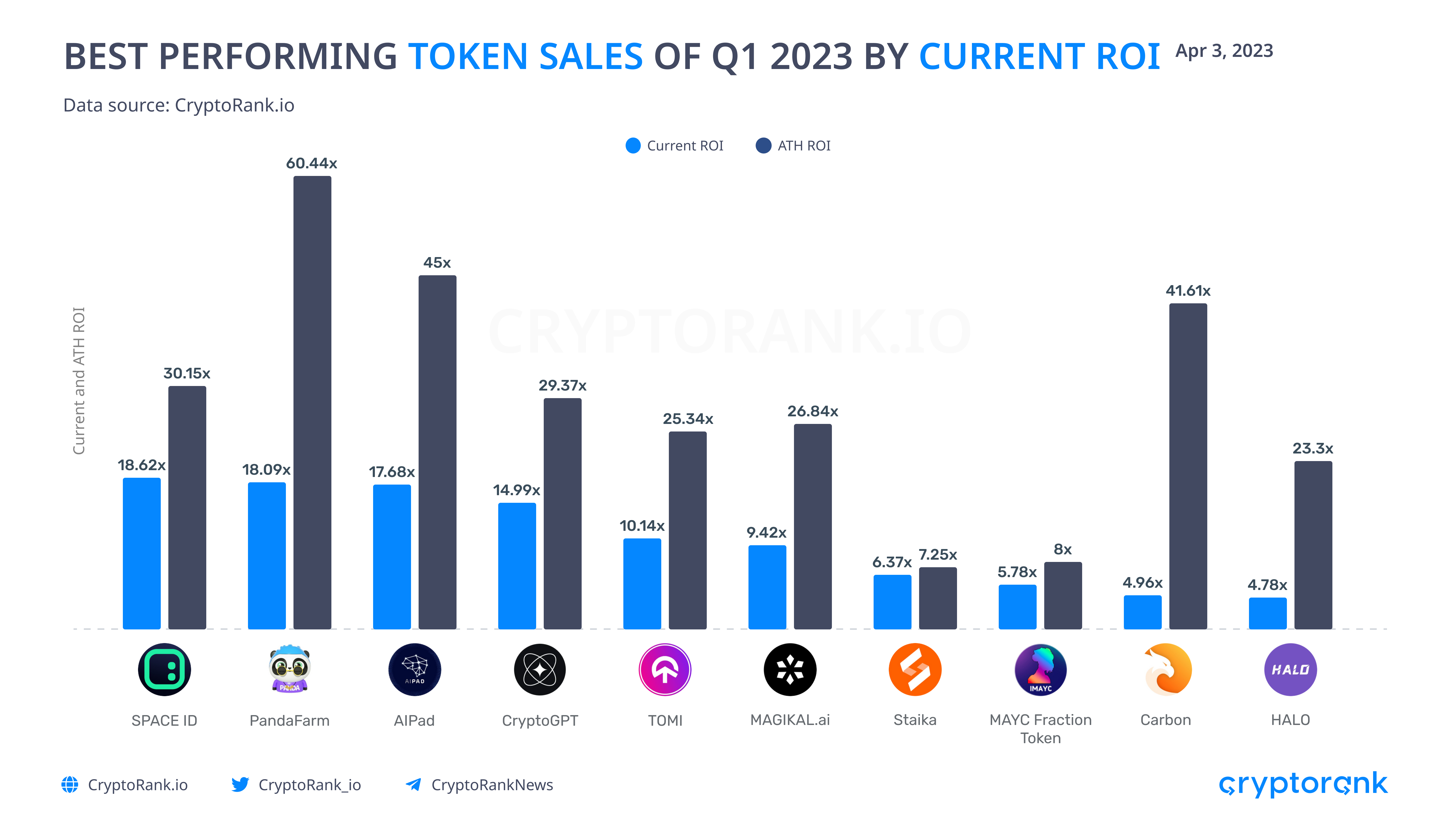

Preliminary Alternate Choices (IEOs) from platforms corresponding to Binance Launchpad, Bitget, and Gate.io Startup generated the best returns for token sale buyers. Nonetheless, the variety of Preliminary DEX Choices (IDOs) outweighed that of IEOs. Among the many high 10 initiatives ranked by present return on funding (ROI), AI-based initiatives carried out notably effectively. Particularly, Area ID confirmed distinctive efficiency, demonstrating the effectiveness of the Binance platform.

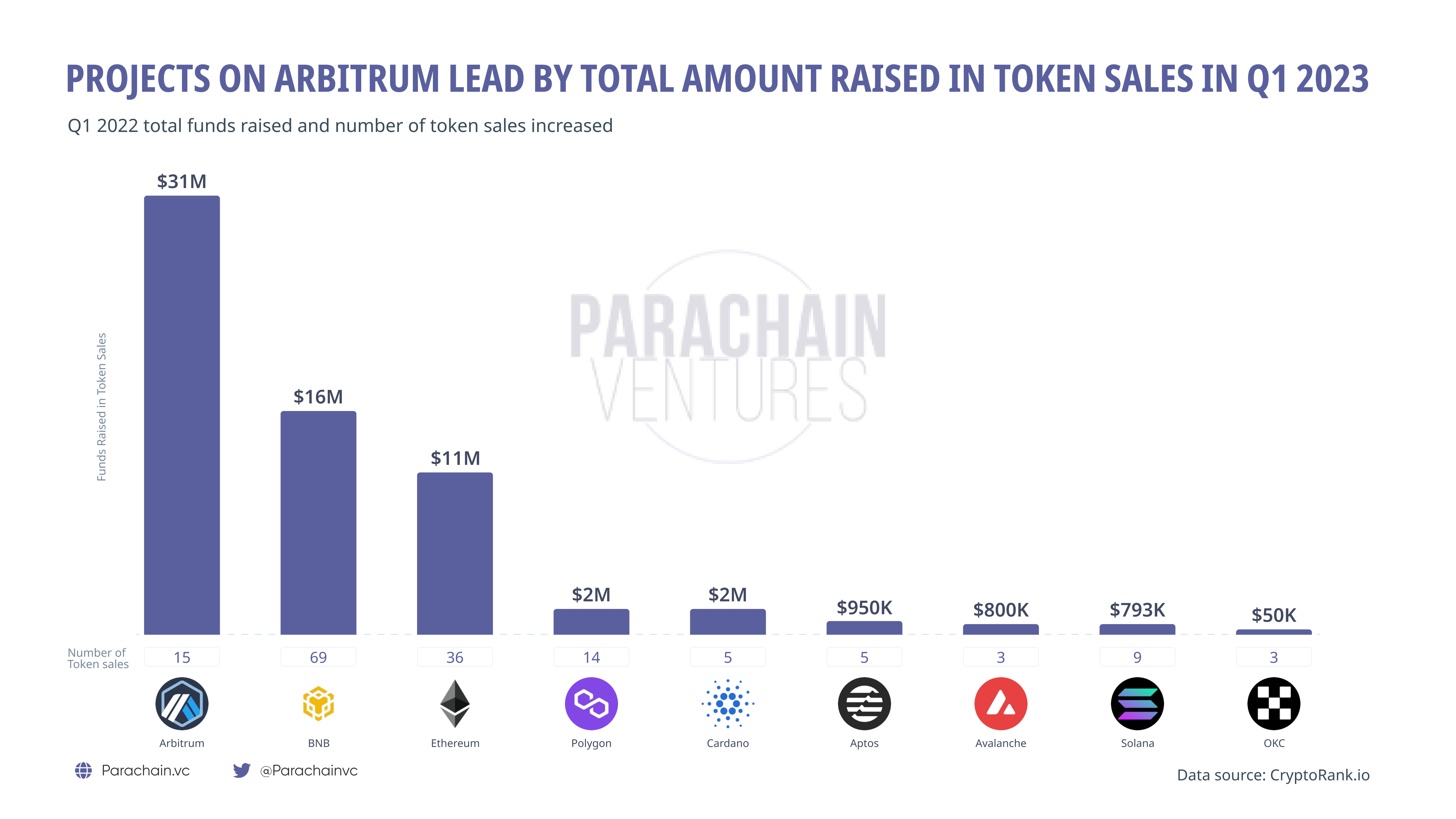

Arbitrum-based initiatives raised the best quantity of funds by means of token gross sales, with a good portion of the success attributed to the a number of extremely profitable token gross sales on Camelot. Nonetheless, whereas Arbitrum led when it comes to whole funds raised, Ethereum and BNB Chain had extra initiatives holding public gross sales throughout the identical interval.

$373M in Crypto Losses From Hacks and Exploits

In response to the REKT Database, Q1 2023 noticed a 92.60% lower in funds misplaced as a result of hacks and exploits, totaling $373 million. This can be a vital enchancment in comparison with the earlier quarter, the place the full reached a staggering $5 billion.

Whereas it is a optimistic pattern, it’s essential to acknowledge that the crypto area nonetheless faces safety considerations.

The Euler Finance hack was some of the outstanding safety breaches, ensuing within the theft of thousands and thousands of {dollars} in varied cryptocurrencies. The hacker stole roughly $196 million, together with DAI, USD Coin, staked Ether (StETH), and Wrapped Bitcoin (WBTC). It was executed through a flash mortgage assault that utilized a multichain bridge to switch funds from the BNB Good Chain to Ethereum. The funds had been then moved to the crypto mixer Twister Money, making it difficult to hint and get better the stolen belongings. Whereas the Euler exploiter returned 51,000 ETH to Euler Finance in March, a number of the stolen funds nonetheless stay with the attacker.

The BonqDAO and AllianceBlock exploit was one other main hack throughout Q1. The attacker manipulated the value oracle to inflate the worth of WALBT and minted over 100 million BEUR. This manipulation enabled them to liquidate a number of troves and withdraw illicit positive factors totaling 113.8 million WALBT and 98 million BEUR, value over $10 million.

Notably, over half of the safety breaches of this era had been noticed on the BNB Chain. Ethereum and Polygon accounted for 18.2% and 9.1% of the full hacks, respectively. These exploits spotlight the necessity for enhanced safety measures on these chains. Plus, customers should train additional warning whereas transacting on them.

Within the crypto business, January 2023 marked a major lower in hacks in comparison with 2022, with solely $14.6 million misplaced in whole. This implies that the business is more and more prioritizing safety and adopting more practical measures to stop hacks and exploits.

Regulatory Name for Stablecoins Following Silicon Valley Financial institution Collapse

The latest Silicon Valley Financial institution (SVB) collapse has raised considerations concerning the want for stablecoin laws. Stablecoins are digital currencies backed by a reserve asset, such because the US greenback, to keep up a secure worth. USD Coin (USDC) from Circle Monetary is a pacesetter within the stablecoin market value over $100 billion. Nonetheless, when SVB failed, Circle revealed it had $3.3 billion in deposits on the financial institution, inflicting USDC to commerce under its $1 peg for 3 days, reaching as little as 88 cents.

This incident has make clear the dearth of pointers within the stablecoin market. Whereas Circle and different stablecoins declare to carry collateral equal to each digital greenback they challenge, Circle had $11 billion in uninsured financial institution accounts. In distinction, Tether has overtly acknowledged that billions of its stablecoin reserves are in company bonds, secured loans, treasured metals, and even different cryptocurrencies.

The incident highlights the pressing want for clear and complete laws to guard buyers and keep stability within the stablecoin market.

The Backside Line

To summarize, the beginning of 2023 has been encouraging for the crypto market, with optimistic indicators within the DeFi and NFT sectors. The discount in funds misplaced to exploits factors to an enchancment in blockchain safety.

The NFT market’s upward trajectory and the DeFi platform’s growth present trigger for optimism over the crypto market’s future. Contemplating these promising developments, we will anticipate a restoration and continued progress within the forthcoming months.

Disclaimer: All data offered in or by means of the CoinStats Web site is for informational and academic functions solely. It doesn’t represent a suggestion to enter into a specific transaction or funding technique and shouldn’t be relied upon in investing choice. Any funding choice made by you is completely at your personal threat. In no occasion shall CoinStats be responsible for any incurred losses. See our Disclaimer and Editorial Tips to be taught extra.