KEY

TAKEAWAYS

- Coinbase inventory has damaged above its buying and selling vary

- The inventory ranked in high place within the SCTR rating for large-cap shares

- The inventory could also be overbought and due for a pullback

The cryptocurrency area has had its share of challenges, however Coinbase (COIN) appears like it could be setting itself other than the pack, particularly after its final earnings report on November 2. COIN’s inventory value is up over 200% this 12 months and it made it to the highest place within the StockCharts Technical Rank (SCTR) rating.

CHART 1: STOCKCHARTS TECHNICAL RANKING (SCTR). COIN made it to #1 place within the Prime 10, Massive Cap class.Chart supply: StockCharts.com. For academic functions.

Within the weekly chart of COIN beneath, you possibly can see that the inventory has damaged above its August 2022 and July 2023 highs. The inventory is buying and selling above its 50-day easy shifting common (SMA). If COIN continues shifting greater, there’s not an excessive amount of by way of resistance. Keep in mind, nevertheless, that the inventory began buying and selling in April 2021, so it is not going to have too many important assist and resistance ranges, particularly in a weekly chart. Nevertheless it’s nonetheless a superb inventory so as to add to your ChartLists, particularly if Bitcoin and different cryptocurrencies arrange for a bullish rally.

CHART 2: WEEKLY CHART OF COINBASE STOCK PRICE. The inventory has damaged above its newer highs. It stays to be seen if the breakout has some follow-through.Chart supply: StockCharts.com. For academic functions.

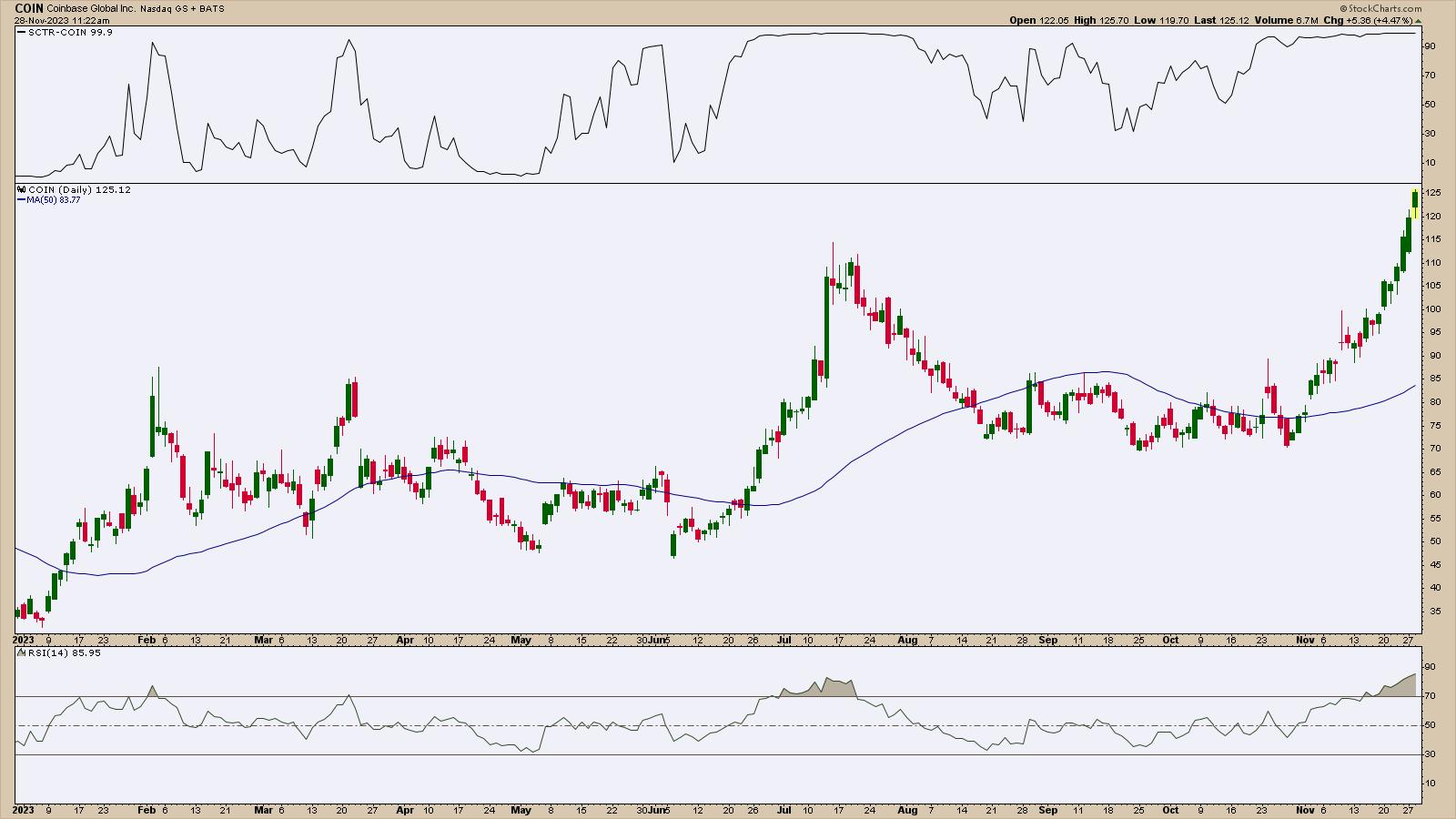

Let’s change to the day by day chart to see extra granularity in COIN (see chart beneath).

CHART 3: DAILY CHART OF COIN STOCK PRICE. The inventory’s pattern is correlated with the pattern in cryptocurrencies. A SCTR rating of 99.9 and RSI of 85 may imply the inventory is overbought. Search for a pullback adopted by a reversal to the upside.Chart supply: StockCharts.com. For academic functions.

With a SCTR rating of 99.9 and a relative power index (RSI) of 85, there’s an opportunity the inventory is overbought. A pullback adopted by a pivot reversal with sturdy upside momentum could be a superb cause so as to add the inventory to your portfolio. Since it is a dangerous play, given the volatility in cryptocurrency, place a decent cease when you enter an extended place.

The worth of COIN inventory strikes in sync with the crypto market. If crypto sees sturdy efficiency by Coinbase’s subsequent earnings date on February 20, COIN’s inventory value may transfer greater. However preserve your ears open for information on the regulatory entrance. Any regulatory threats may ship crypto costs decrease, quick.

What is the Significance of the SCTR Rating?

In a nutshell, SCTR is a numerical rating that ranges from 1 to 100. The upper the worth, the upper the inventory’s rank. To get a excessive SCTR rank, a inventory or ETF ought to rating excessive with all the indications used to calculate the SCTR rating and within the brief, medium, and long-term time frames.

The SCTR rating identifies the leaders and laggards inside particular trade teams. Because the calculations are executed for you, all you need to do is add the indicator panel on SharpCharts or StockChartsACP.

How To Add the SCTR Line to Your Charts

- Within the SharpCharts Workbench, from the Indicators dropdown menu, click on SCTR Line.

- In StockChartsACP, click on on SCTR Line from the Commonplace Indicators record.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to coach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra